In today’s digital and competitive world, customers expect immediate support and personalized experiences from contact centers for financial institutions.

Often bogged down by outdated technology and manual processes, traditional contact centers need help to meet these rising expectations.

Long wait times, inconsistent service quality, and the inability to provide personalized interactions have become common pain points.

As a result, customer satisfaction drops, and operational costs soar, leaving financial institutions disadvantaged in a rapidly evolving market.

This is where AI steps in.

Artificial intelligence in finance along with fintech software development services, addresses these pain points head-on by automating routine tasks, analyzing vast amounts of data in real-time, and providing insights into customer behavior.

A report found that 69% of banks and financial institutions are already investing in AI to maintain a competitive edge.

These organizations are leveraging AI technologies like predictive analytics, speech analytics, and virtual agents to streamline operations, deliver more personalized customer experiences, and ensure regulatory compliance.

But what if your financial contact center fails to embrace AI?

Without AI, your contact center may continue to struggle with inefficiencies, leading to frustrated customers and higher churn rates.

On the flip side, the opportunities presented by AI are immense.

In this article, we will explore how AI is revolutionizing financial contact centers by diving into the top AI technologies that are making an impact.

A. Role of artificial intelligence in finance

Artificial intelligence (AI) is transforming the finance industry by making processes smarter, faster, and more efficient.

When you think about the role of AI in finance, it’s all about enhancing the way financial institutions serve you and manage their operations.

AI helps in analyzing vast amounts of data quickly, allowing personal finance app banks and financial services to offer personalized advice, detect fraud, and manage risks better.

For example, AI-powered chatbots can answer your queries 24/7, providing instant support.

AI can also help in processing loan applications faster by evaluating your creditworthiness in seconds rather than days.

Moreover, AI plays a crucial role in fraud detection.

By analyzing transaction patterns, AI can identify suspicious activities and alert you immediately, keeping your money safe.

In investment management, AI assists in making data-driven decisions, helping to predict market trends and manage your portfolio more effectively.

Overall, Generative AI in FinTech is reshaping finance by improving customer experience, increasing security, and driving efficiency.

Whether you’re managing your bank account, applying for a loan, or investing in stocks, AI is there, working behind the scenes to make things easier and more secure for you.

B. 9 AI technologies in financial contact centers

Based on our research and keeping the context of the year 2024, here’s a list of the top AI technologies in financial contact centers that any business can prefer:

1. Speech Analytics

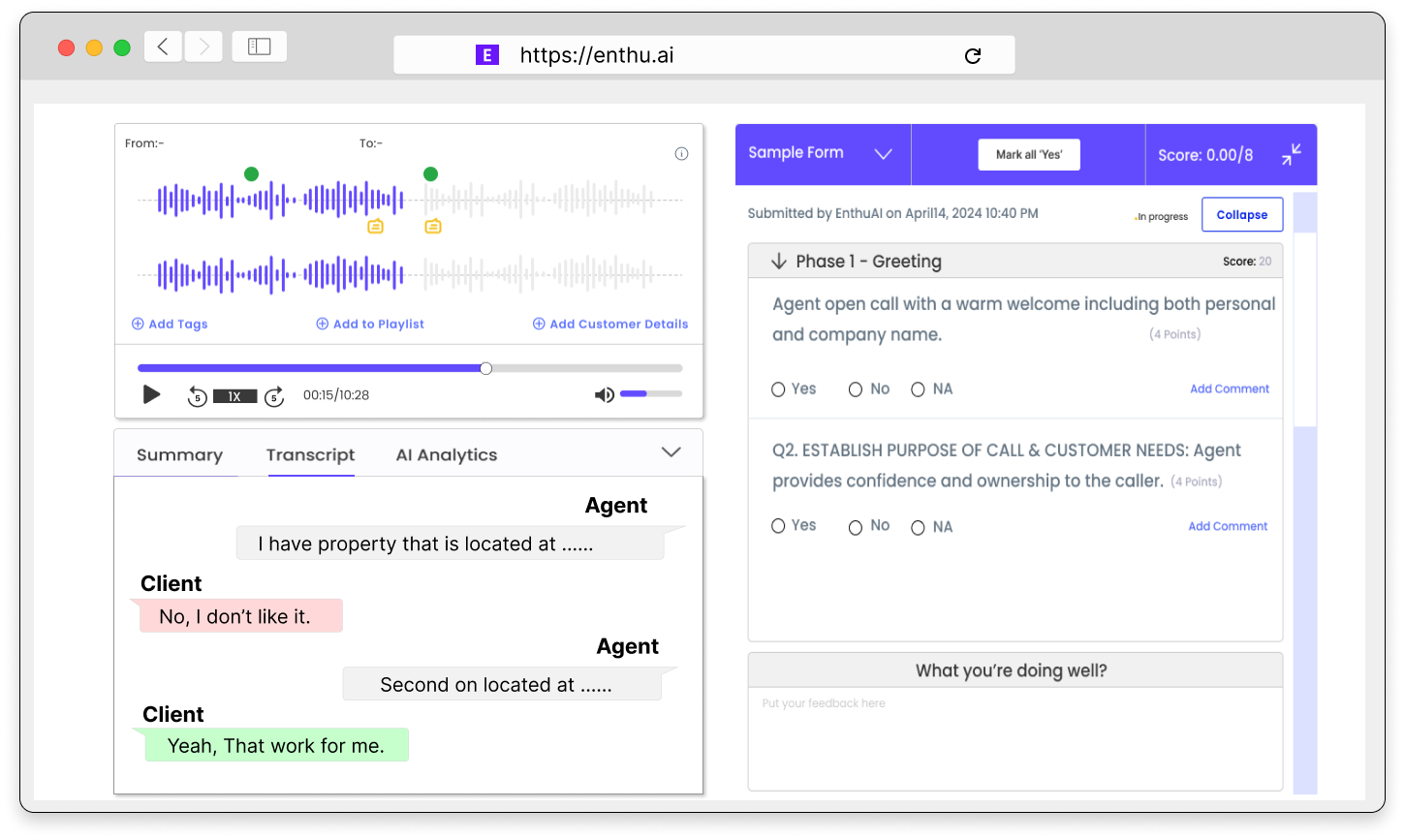

Speech analytics is one of financial contact centers’ most powerful AI tools.

It analyzes voice interactions between customers and agents, extracting valuable insights to improve customer service.

You can identify trends, understand customer sentiment, and even detect compliance issues with speech analytics.

For example, if a customer frequently calls about a specific problem, speech analytics can identify this pattern and help you address the issue proactively.

Moreover, it aids in quality assurance by monitoring calls for adherence to scripts and compliance requirements.

2. Predictive Call Routing

Predictive call routing uses AI to match customers with the most suitable agent based on historical data and real-time analytics.

This technology ensures that customers are connected to agents who are best equipped to handle their specific needs.

It helps you improve customer satisfaction and reduce call resolution times.

By analyzing previous interactions and customer data, predictive call routing can anticipate the customer’s needs and route them to the right agent.

It makes the process more efficient and personalized.

3. Sentiment Analysis

Sentiment analysis is another crucial AI technology in financial contact centers.

It involves analyzing customer interactions to determine their emotional tone.

This analysis helps understand customer satisfaction levels and identify areas where improvements are needed.

With sentiment analysis, you can gauge how customers feel about your services in real-time.

The system can alert agents or supervisors if a customer is frustrated or upset.

Therefore, it allows them to take immediate action to resolve the issue and improve the customer experience.

4. Predictive Analytics

Predictive analytics in finance uses historical data to forecast future outcomes.

In contact center AI, this technology can predict call volumes, customer behavior, and even the likelihood of a customer churning.

By anticipating these trends, you can make informed decisions and implement strategies to enhance customer retention and service quality.

For example, if predictive analytics shows a spike in call volumes during a particular period, you can allocate additional resources to handle the increased demand, ensuring that customer service levels remain high.

5. Agent Quality Analysis and Training

AI-driven agent quality analysis helps in evaluating agent performance by analyzing various metrics such as call handling time, customer satisfaction scores, and adherence to scripts.

This analysis provides insights into areas where agents excel and where they need improvement.

Based on these insights, you can design personalized training programs to enhance agent skills and ensure that they are well-equipped to meet customer expectations.

Continuous monitoring and training ensure that your team maintains high performance and delivers exceptional service.

6. Conversation Bots/Virtual Agents

Conversation bots, also known as virtual agents, are AI-powered tools that handle routine customer inquiries without human intervention.

These bots can manage tasks such as account inquiries, transaction history, and even basic troubleshooting.

This allows freeing up human agents to focus on more complex issues.

Since virtual agents are available 24/7, they can provide customers with immediate assistance.

They can handle multiple interactions simultaneously and ensure your contact center operates efficiently, even during peak times.

7. Customer Behavior Analysis

Customer behavior analysis uses AI to understand how customers interact with your services.

By financial data analysis using AI such as transaction history, browsing behavior, and interaction patterns, you can gain insights into customer preferences and tailor your services accordingly.

This technology helps you anticipate customer needs and provide personalized experiences, increasing customer satisfaction and loyalty.

For example, if customers frequently check mortgage rates, you can proactively offer them tailored mortgage products, enhancing their overall experience.

8. Fraud Detection

Fraud detection is a critical application of artificial intelligence finance.

AI algorithms can analyze large datasets to identify patterns and anomalies indicating fraudulent activity.

In contact centers, this technology helps monitor transactions and interactions for signs of fraud, ensuring the security of customer information.

Using AI for fraud detection, you can quickly identify and mitigate potential threats and protect your customers and your organization from financial loss.

9. Customer Experience Optimization

Customer experience optimization uses AI to enhance every aspect of the customer journey.

This includes personalizing interactions, predicting customer needs, and providing timely solutions.

By optimizing the customer experience, you can build stronger relationships with your customers and increase their loyalty to your brand.

AI technologies like predictive analytics, sentiment analysis, and conversation intelligence play a crucial role in optimizing customer experiences in financial contact centers.

C. Benefits of AI for the financial sector

Artificial intelligence in finance brings a wealth of advantages to the financial sector, transforming how institutions operate and serve their customers.

Here’s how AI can make a real difference for you:

- Automation: AI can streamline and automate repetitive tasks, such as verifying documents or answering routine questions. This means you can handle more tasks efficiently without manual intervention. For instance, AI can continuously monitor network traffic for cybersecurity or enhance digital banking experiences by personalizing services based on client needs.

- Accuracy: By minimizing manual errors, AI ensures that tasks like data processing, analytics, and document handling are done consistently and correctly every time. This reduces mistakes and provides more reliable outcomes in your operations.

- Efficiency: AI takes over routine, repetitive tasks, freeing up your team to focus on strategic activities. Whether it’s summarizing documents, transcribing calls, or handling simple customer inquiries, AI bots can handle these tasks, improving overall productivity.

- Speed: AI processes information faster than humans, quickly identifying patterns and relationships in data. This rapid analysis helps you make faster decisions, manage risks better, and respond to compliance requirements swiftly.

- Availability: AI works around the clock, allowing customers to access financial services and solutions whenever needed. Cloud-based AI systems can continuously handle tasks, ensuring you provide uninterrupted service.

- Innovation: With AI’s ability to analyze large volumes of data, you can develop new and innovative products and services. AI-driven predictive analytics can modernize customer experiences and keep you ahead of the competition.

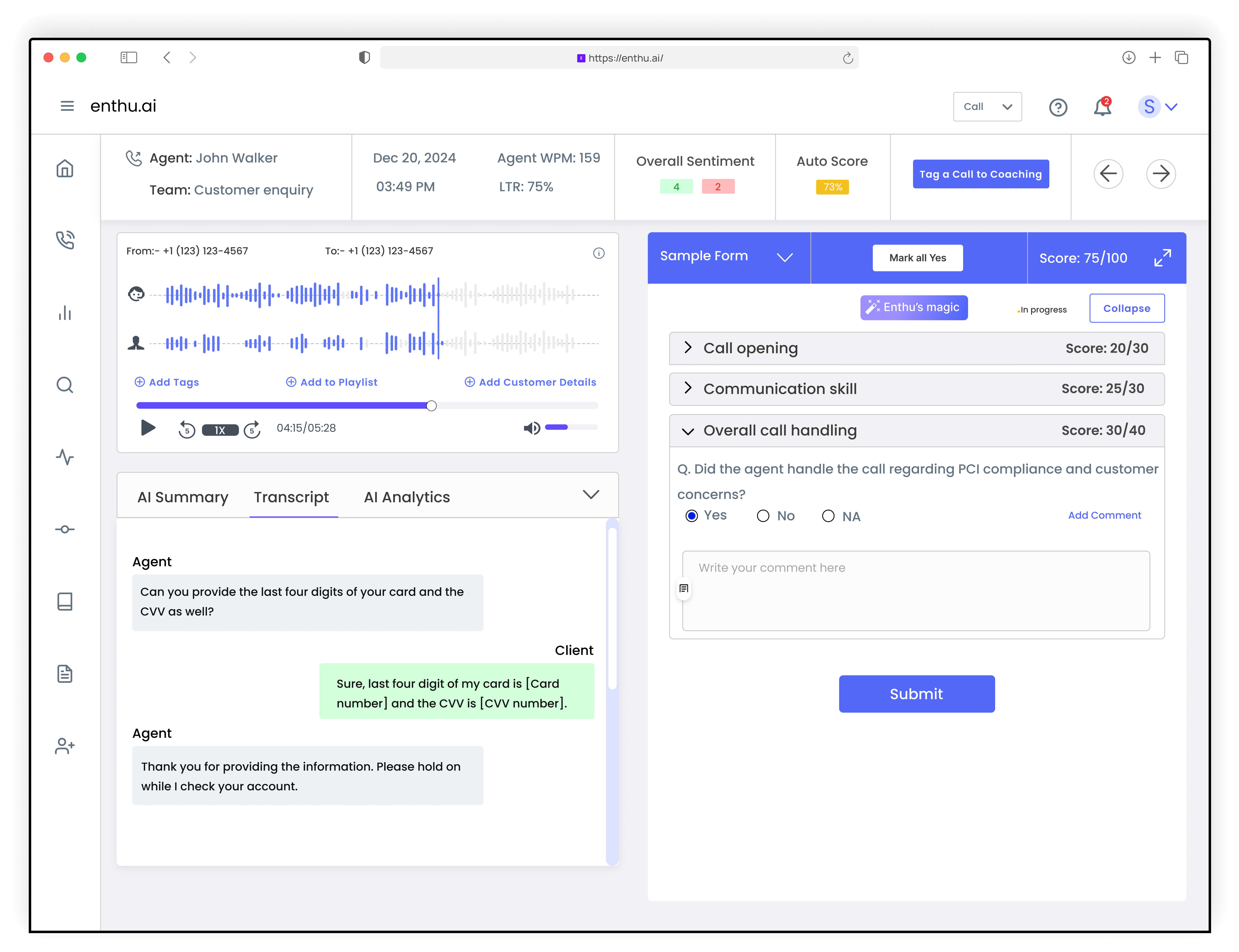

D. How Enthu.AI drives more business to the financial sector

Running a contact center for a bank, lender, or credit union comes with its own set of challenges. It’s a tough job, from managing regulatory compliance to meeting customer expectations.

Enthu.AI is here to make it easier and help you drive more business. Here’s how:

- Boost Compliance: Enthu.AI ensures your agents are always on top of compliance requirements. It helps make sure they disclose all necessary information and adhere to banking regulations, keeping you safe and sound.

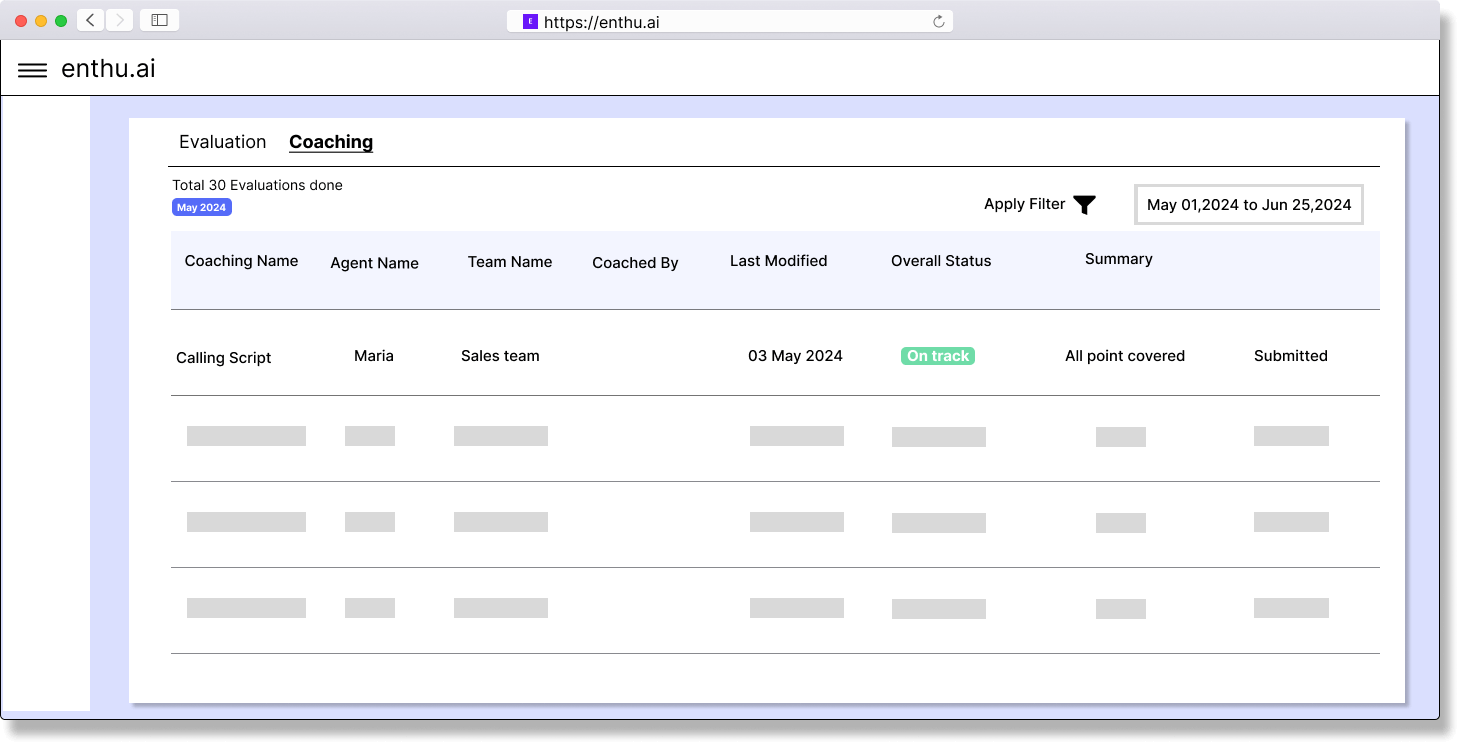

- Automate Quality Assurance: With Enthu.AI, you get 100% call QA coverage without needing extra manpower. This means you can identify coaching opportunities and improve agent performance effortlessly.

- Accelerate Training: Reviewing a 30-minute call used to take a lot of time. With Enthu.AI, you can analyze calls in seconds. This speeds up your training process and lets you focus more on coaching your agents.

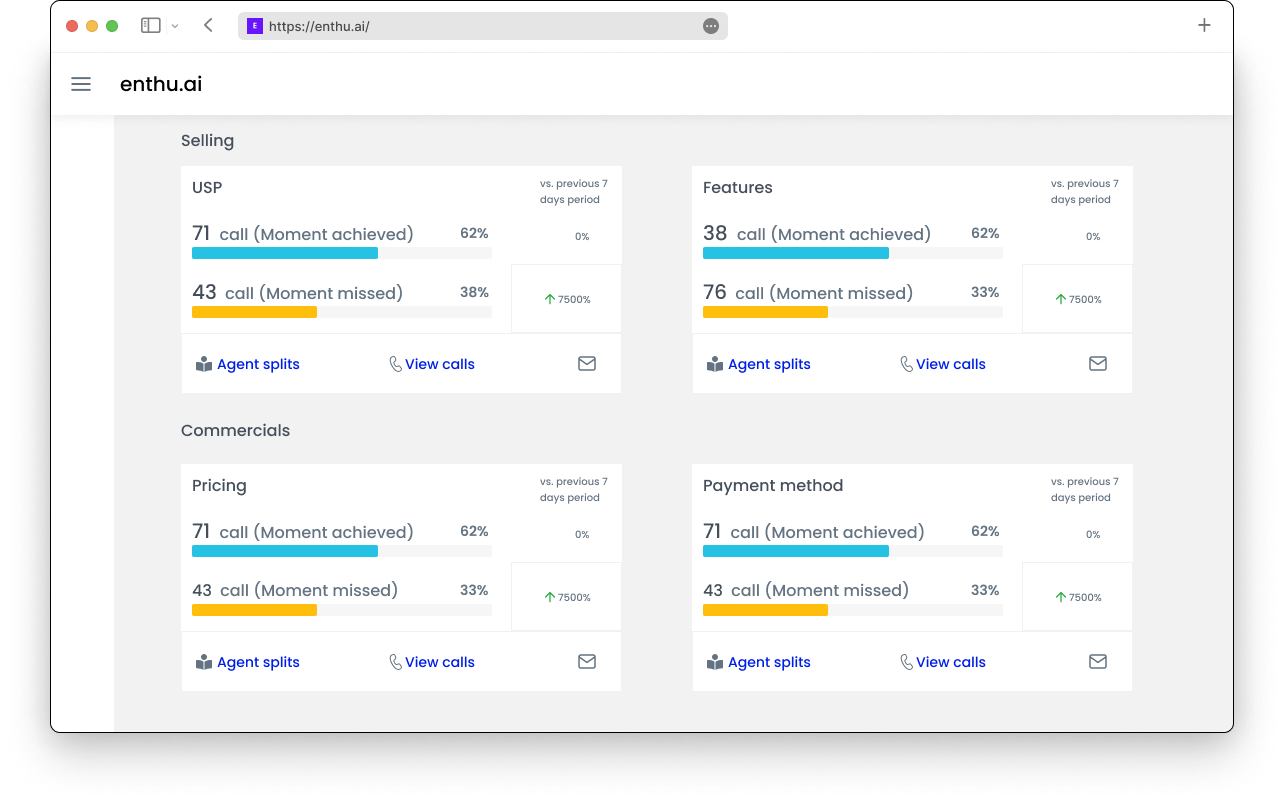

- Increase Revenue: Enthu.AI helps you spot the winning behaviors of your top-performing agents. You can boost overall revenue performance by replicating these behaviors across your team.

- Improve Customer Experience: Identify and address your customers’ common concerns. Enthu.AI helps you group these issues and trains your agents to resolve them more efficiently, enhancing customer satisfaction.

- Reduce Agent Attrition: Working in financial sales and support can be stressful. Enthu.AI helps create a supportive environment by providing valuable feedback and fostering a culture of continuous learning, which can reduce agent turnover.

- Minimize Customer Churn: Understand why your customers leave and train your agents to handle these issues better. Enthu.AI helps you identify these reasons and take proactive measures to keep your customers happy.

Conclusion

In conclusion, embracing AI in your financial contact center isn’t just about keeping up with technology—it’s transforming how you serve customers and run operations.

Integrating AI tools can enhance efficiency, personalize experiences, and boost compliance.

The result?

Happier customers, more effective agents, and a competitive edge in the financial sector.

Investing in AI is a smart move if you want to stay ahead and meet your customers’ growing expectations.

With AI, you’re not just adapting but thriving in a fast-paced, digital world.

On this page

On this page