Conversation intelligence for banks, lenders and credit unions.

- Free 14 day trial

- No Credit Card required

- Quick setup

Running a contact center for a bank/lender is a tough job. On one side, you need too take care of myriad of regulatory compliances and data disclosures, on the other side the customer is spoilt with choices and churns at a breakneck speed.

Customers who churn list poor service, too long a wait time and untrained agents as the top 3 reasons. In such a scenario, reactive retention strategies won’t work any longer. Contact centers need to ensure they are pro active not in just understanding the customer pain points but also solving them as fast as possible.

To make this happen, deriving customer intelligence and putting that to perspective while coaching your agents should be the utmost priority of your banking contact center. Enthu can help you not just retain your existing bank customers but also win & service the new ones better.

Ensure the calling agents are disclosing complete information & adhering to multiple compliance aspects of telemarketing + banking.

Ensure 100% call QA coverage to surface out agent coaching and training opportunities, without the need to add any additional manpower.

Accelerate your agent training process by reviewing a 30 mins call in a few seconds. Focus more on coaching than listening to the calls.

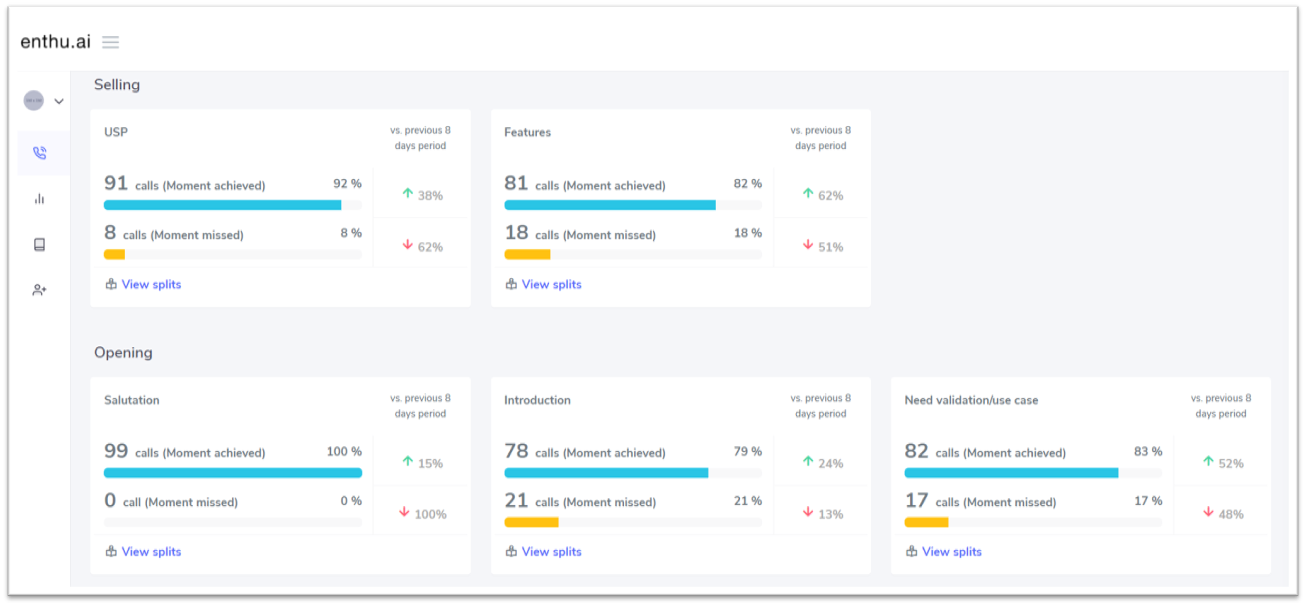

Enthu helps you identify the winning behaviors of your top agents so that you can replicate them across the team to boost the revenue performance.

Identify and group the most common concerns your customers exhibit, and then train your agents to resolve them better & faster.

Surface out the most common sales objections that your agents face day in and out. Use it as a coaching input to train the agents better.

Banking sales & support jobs are full of stress. Make them more meaningful by building an environment of feedback, coaching and mutual learning.

Analyze customer interactions to pinpoint broken aspects of your customer experience, and use it as an opportunity to fix the customer experience.

Identify the most common reasons why your banking customers churn. Then train your agents to handel such concerns better.

Absolutely. When you sign up for Enthu, you get a free 14 days trial to our fully functional plan.

Please go ahead and try it. Once you are satisfied and convinced, you can always upgrade to a paid plan.

All our plans are custom and per agent basis, based on your consumption level and data analysis needs.

Kindly book a slot here to discuss your speech analytics needs in details.

Absolutely. Enthu is 100% customizable for your use case, be it sales, customer support, customer success or anything else.

You can replicate your calling themes/scripts within Enthu, without the need of a developer. It’s as easy and simple as using any popular web based software.

Enthu can support agents across contact centers of all sizes. We do offer volume discounts on number of agent seats you opt for.

Please get in touch with us and we will be glad to offer you a custom plan.

Yes, Enthu is a horizontal product that replicates your calling theme. So whether you are run a contact center for a bank, lender or a credit union, , you can use Enthu without any worry.

Currently, Enthu works exceptionally well for voice calls in English, covering all major accents including American, British, European, Indian, South African, South East Asian etc.

Enthu takes security very seriously. All our data is stored on AWS and protected using enterprise level security procedures. All your personal & call data is encrypted, both at rest and while in transit. You can read more here about our security features.

No worries. You can chat with our customer success agent, or you can shoot your queries via email to hello@enthu.ai

Enthu takes pride in being a complete conversation intelligence solution for driving superior calling performance – it’s pocket friendly, easy to integrate & use, and comes with a support you can trust on.

Sign up for a 14-day free trial.

COPYRIGHT © 2024 – enthu.ai | Privacy Policy | DPA | Terms