As digitization now dominates the global banking system, customer expectations of financial institutions have risen noticeably.

They want a lightning-fast response, 24*7 customer support, and a personalized experience across service channels and payment platforms.

So, if you’re managing an inbound call center for a bank, your job just becomes even more challenging.

It’s the quality of your customer service that decides whether a customer will stay with your bank or switch to another.

According to the latest report, “73% of consumers will switch to a competitor after multiple bad experiences.”

It’s evident from the fact that providing exceptional customer service is important if you want to run and grow your financial business successfully.

You need an advanced solution that can identify and solve these pain points.

In today’s technically advanced banking world, what’s better than artificial intelligence (AI) to provide transformational results?

By leveraging AI in call centers, you can better understand your customers’ sentiments & behaviors, automate repetitive tasks, provide real-time support, train & coach agents, and offer tailored solutions to streamline operations and improve customer satisfaction.

In today’s article, we’ll discover the top 11 real-world applications of AI in banking that are transforming modern contact centers.

A.What is the Role of Artificial Intelligence in Banking?

If you run a banking call center, you’ve likely noticed how AI in banking has transformed many of your processes.

AI enhances efficiency by automating routine tasks, providing quick responses, and reducing the workload on human agents.

Traditionally, banking operations were manual, time-consuming, and prone to human error.

Many financial institutions now rely on custom banking software development services to modernize legacy systems and prepare infrastructure for AI-driven automation.

AI technologies, including machine learning and natural language processing, have automated routine tasks such as data entry and transaction processing, significantly reducing operational costs and errors.

However, over 90% of banking centers report integration issues, 79% have security concerns, and 64% worry about ethical AI usage.

If you’re hesitant to adopt AI, consider these roles that AI plays in banking call centers:

AI is revolutionizing banking through:

- Fraud detection: Identifies and prevents fraudulent transactions in real-time.

- Customer support: Automates responses via chatbots and virtual assistants.

- Personalization: Offers tailored financial advice and product recommendations.

- Risk management: Analyzes data to assess and mitigate financial risks.

- Credit scoring: Provides more accurate lending decisions using diverse data.

- Compliance: Automates regulatory tasks and reporting.

- Operational efficiency: Streamlines processes and reduces costs through automation.

- Security: Enhances threat detection and response.

- Market insights: Analyzes trends for strategic decision-making.

- Loan processing: Speeds up approvals by automating tasks.

B. 11 AI applications in banking contact centers

The banking sector’s expenditure on artificial intelligence (AI) is expected to rise to $84.99 billion by 2030, reflecting an impressive compound annual growth rate of 55.55 percent.

Bank contact centers worldwide already started using this technology to improve customer service.

What are you waiting for?

Here are the top 11 applications of AI in banking industry that you can use to automate your processes, streamline operations, and take your financial call center business to the next level.

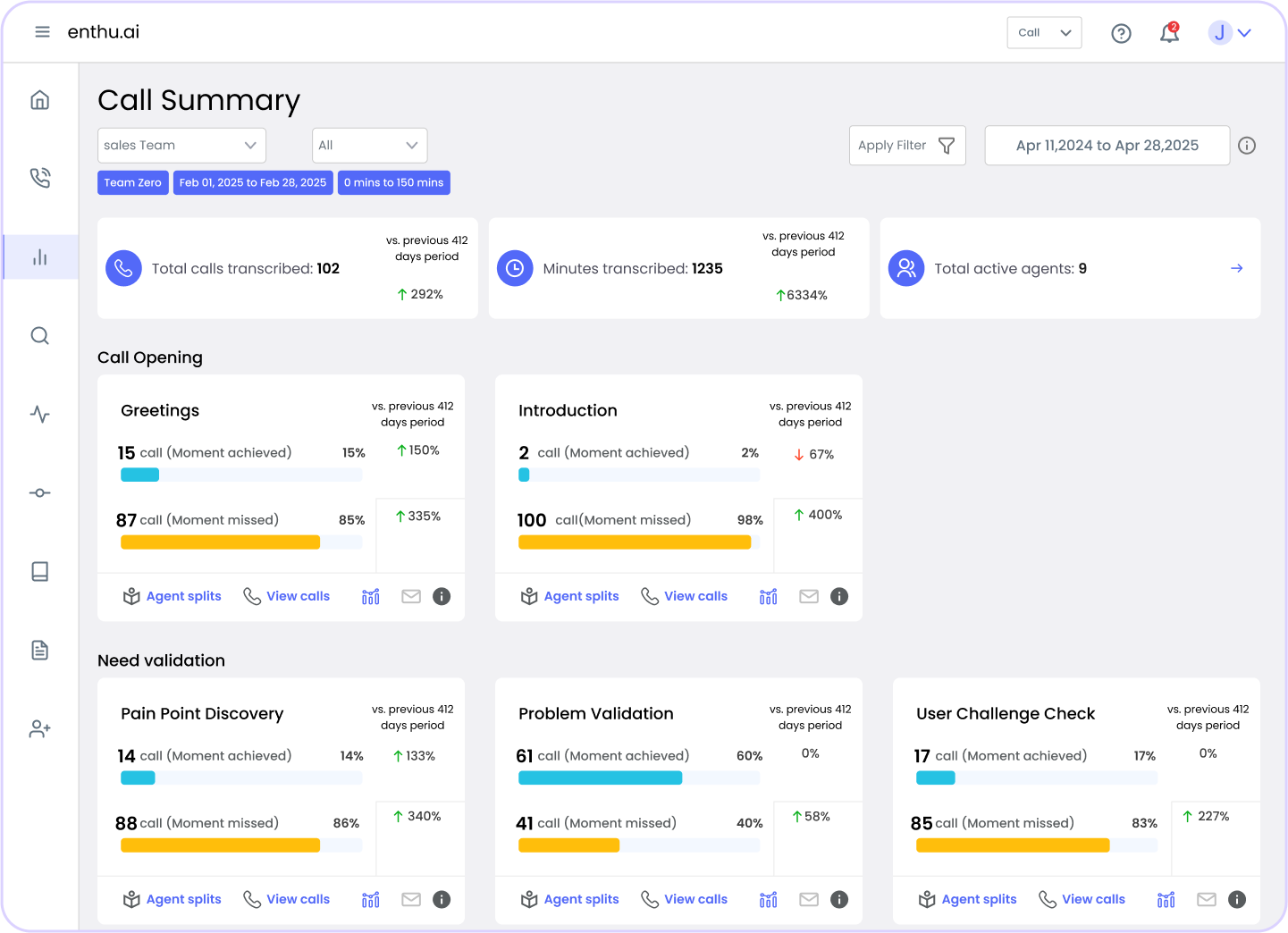

1. Speech Analytics

Implementing speech analytics in your call center means you’re not just responding to problems; you’re proactively enhancing your customer interactions and boosting loyalty.

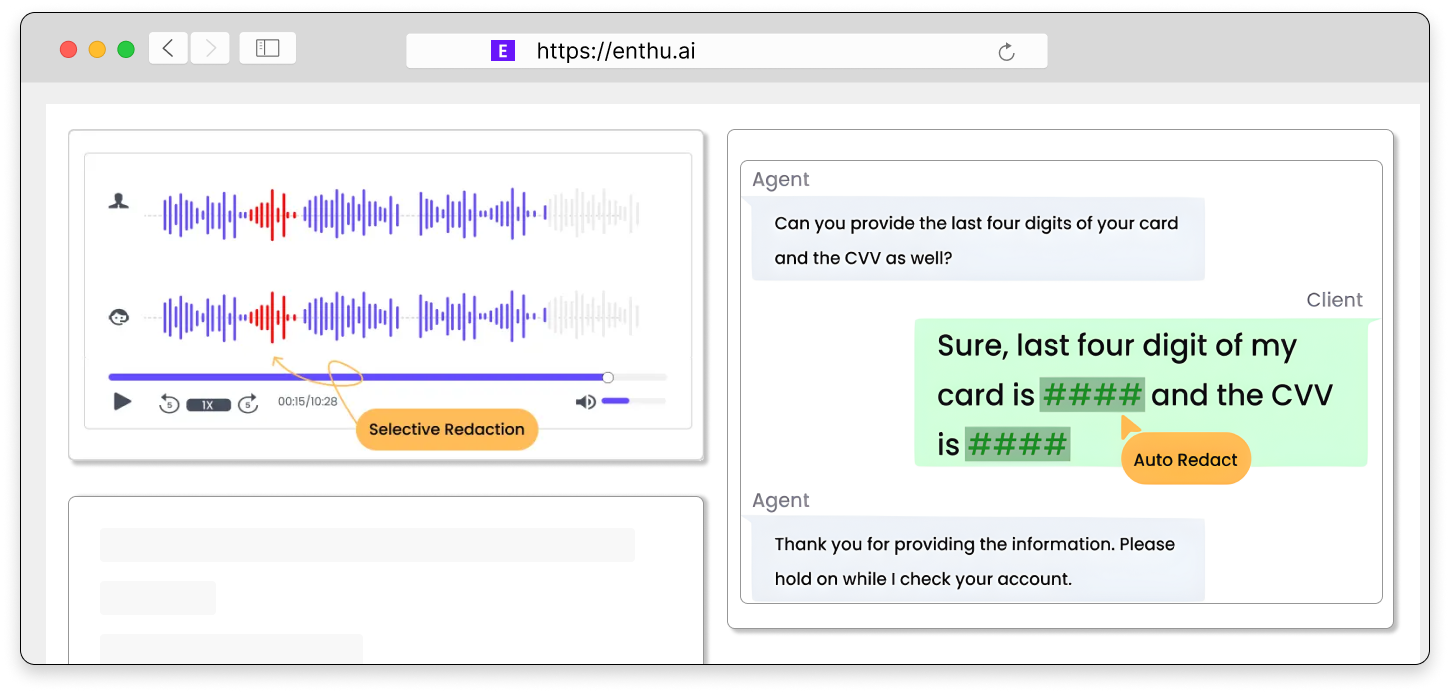

This AI-driven tool analyzes every call to detect patterns and key phrases that might indicate customer dissatisfaction while ensuring compliance with PII Redaction to protect sensitive information.

By pinpointing issues like frustration or intent to switch banks, Speech Analytics helps you address problems before they escalate.

Moreover, with advanced natural language processing (NLP), speech analytics helps you understand customer sentiment and anticipate their needs, providing agents with real-time support.

Imagine knowing which calls need immediate attention or identifying trends in customer complaints.

This insight enables you to enhance your service, reduce call volume, and train your agents more effectively.

2. Predictive Call Routing

Did you know that only 18% of callers rate their contact center experience as excellent?

That’s because many contact centers struggle with ensuring each customer speaks to the right agent who can resolve their issue quickly and effectively.

Predictive call routing can change this.

By using AI to analyze customer profiles, call history, and inquiry types, predictive call routing matches each caller to the most suitable agent.

This means your customers are more likely to get their problems resolved on the first call, reducing frustration and wait times.

Not only does this boost first contact resolutions, but it also lightens the load for agents and improves overall contact center efficiency.

With predictive call routing, your customers and agents will both benefit from a smoother, more effective service experience.

3. Sentimental Analysis

Sentiment analysis in banking contact centers uses AI to gauge customer emotions during interactions.

By analyzing conversations through Natural Language Processing (NLP) algorithms, sentiment analysis helps identify whether customers feel positive, negative, or neutral about their experiences.

This real-time understanding allows agents to tailor their responses, addressing issues empathetically and efficiently.

For example, if a customer expresses frustration, the system alerts agents to quickly prioritize and resolve the issue.

Additionally, sentiment scores provide insights into agent performance and help refine training programs, ultimately enhancing overall customer satisfaction and service quality.

4. Predictive Analytics

By analyzing historical data, predictive analytics anticipates future customer behaviors and needs in your financial call center.

This means you can predict who might need a call back, identify potential issues before they arise, and better understand customer preferences.

For instance, it can forecast which customers are likely to churn, allowing you to address their concerns proactively.

Moreover, predictive analytics helps tailor marketing offers and optimize staffing by predicting call volumes.

By leveraging these insights, you improve operational efficiency and provide a more personalized and proactive customer experience.

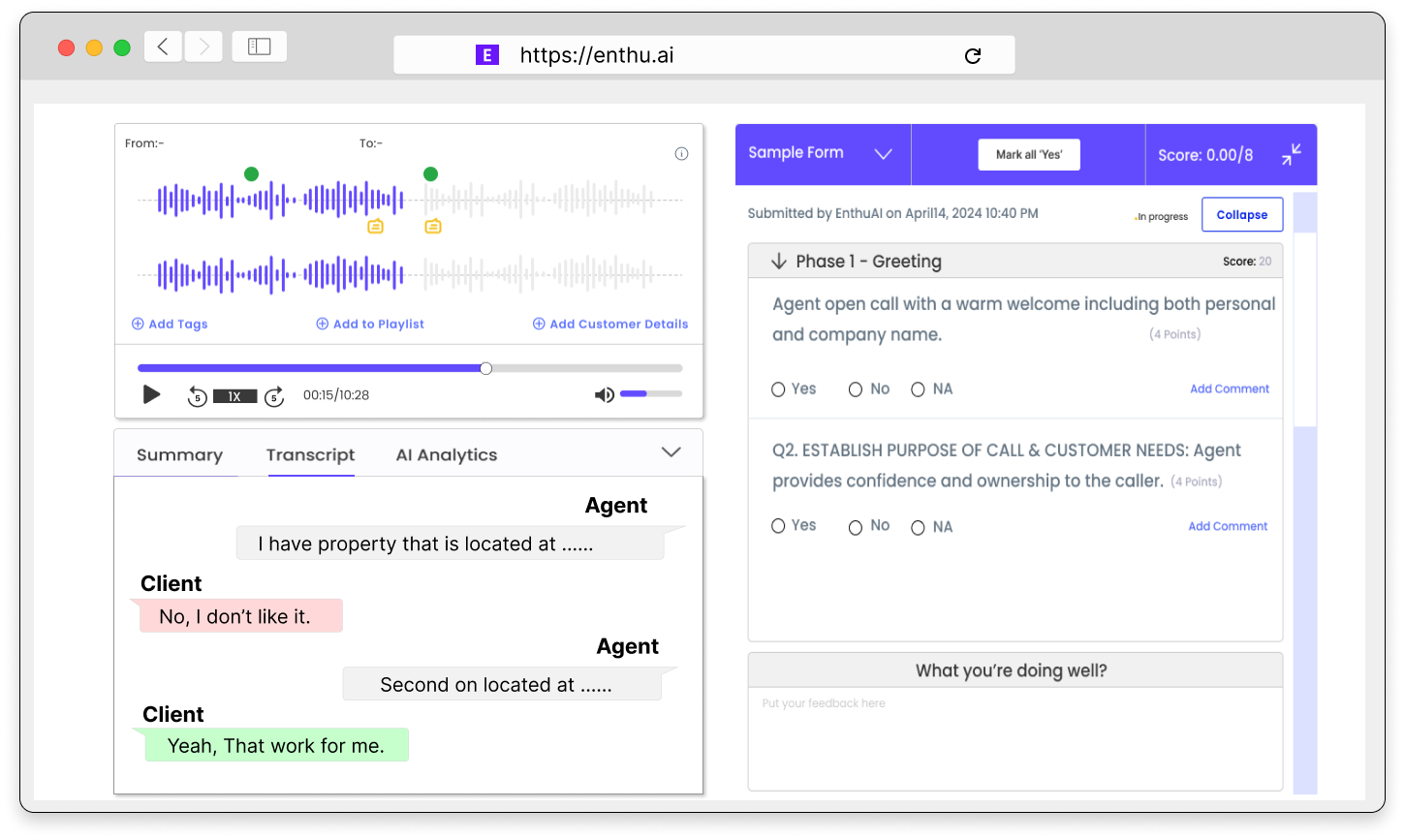

5. Agent Quality Analysis and Training

Embracing artificial intelligence in banking call centers ensures your team is well-trained, compliant, and ready to excel.

By automating performance monitoring, AI evaluates 100% of calls for quality and compliance, providing an objective view that ensures all interactions meet your standards.

This leaves more time for solving call handling issues and less time spent on manual QA checks.

In addition, AI delivers real-time feedback and insights, which helps in enhancing training programs.

It supports continuous learning and improvement by pinpointing areas for development and boosting overall agent performance.

6. Conversation bots/ virtual agents

In today’s call centers, AI-powered conversation bots, also known as virtual agents, don’t just answer questions; they engage in natural, human-like conversations, understanding the intent behind customer queries.

By handling routine tasks like scheduling, troubleshooting, and providing account information, they free up human agents to focus on more complex issues.

Virtual agents work 24/7, offering personalized support and faster response times, ultimately improving customer satisfaction while reducing operating costs.

7. Customer Behavior Analysis

With AI-powered customer behavior analysis in your banking call center, you gain a deep understanding of your client’s needs and preferences.

The AI analyzes past interactions, transaction patterns, and inquiries to identify key behaviors.

For example, if a customer frequently inquires about loan products, the AI can prompt your agents to offer tailored financial advice or promotions.

This proactive approach not only enhances customer satisfaction but also strengthens loyalty by anticipating their needs.

8. Fraud Detection

By continuously learning and adapting, AI makes it harder for fraudulent activities in banks to go unnoticed, enhancing overall security.

AI-powered solutions help you analyze vast amounts of transaction data in real-time, identifying suspicious patterns that may indicate fraud.

For example, if someone tries to access a customer’s account from an unusual location or makes an unexpectedly large withdrawal, the AI system flags it immediately, prompting further investigation.

This proactive approach helps banks stay ahead of fraudsters, ensuring a secure and trustworthy environment for customers.

9. Regulatory compliance

In a banking call center, AI tools automatically monitor and analyze every interaction, identifying potential risks and flagging non-compliant behavior.

AI helps you stay ahead by keeping track of ever-changing regulations, ensuring your team follows the rules.

This protects your organization from fines and penalties and builds trust with your customers.

Using AI in banking, you can streamline compliance processes, reduce manual errors, and focus on delivering excellent service, knowing that your regulatory obligations are being met efficiently and accurately.

10. Loan and credit decisions

In the banking sector, AI is revolutionizing how loan and credit decisions are handled.

Instead of relying on lengthy manual reviews, AI systems quickly analyze vast amounts of data, such as credit histories and income levels.

For example, when a customer applies for a loan, AI algorithms can swiftly evaluate their financial situation and determine their creditworthiness.

This speed accelerates loan approvals and reduces the potential for human error and bias.

AI in banking ensures consistency in decision-making, which is crucial for maintaining fairness and complying with regulatory standards.

11. Automated Call Summaries

AI-powered automated call summaries transform how banking contact centers handle post-call tasks.

Instead of manually reviewing and summarizing each conversation, AI quickly generates concise summaries highlighting key points, actions, and follow-ups.

This speeds up the documentation process, ensuring no critical details are missed.

With these summaries, agents can quickly review calls, improve their responses, and provide better service in future interactions.

Additionally, these summaries help in training and performance assessments by providing clear, consistent insights into each call, ultimately enhancing overall efficiency and customer satisfaction in your call center.

C. Benefits of AI in banking sectors

AI adoption in banking is projected to reduce costs by 22% over the next five years.

Wondering how AI-powered solutions can benefit your business?

Here’s a look at some key advantages:

1. Reduced operational costs

AI helps banks cut costs by automating repetitive tasks like data entry.

For instance, robotic process automation (RPA) can handle paperwork and data management more efficiently than human staff, reducing errors and saving time.

2. Enhanced customer experience

With AI-powered chatbots, banks can offer 24/7 customer support.

These chatbots handle common queries and transactions at any time, making banking more convenient and accessible for customers.

3. Improved fraud detection

AI excels at spotting fraudulent activities by analyzing vast amounts of data quickly.

It can detect unusual patterns and potential fraud in real-time, offering higher security than traditional methods.

4. Better loan and credit decisions

AI systems analyze more than just credit scores to assess loan applications.

They consider various data points and patterns, helping banks make more informed and accurate lending decisions.

5. Automation of investment processes

AI helps banks in investment decisions by analyzing market trends and opportunities.

It can identify potential investments and support robo-advisers that guide customers in managing their portfolios.

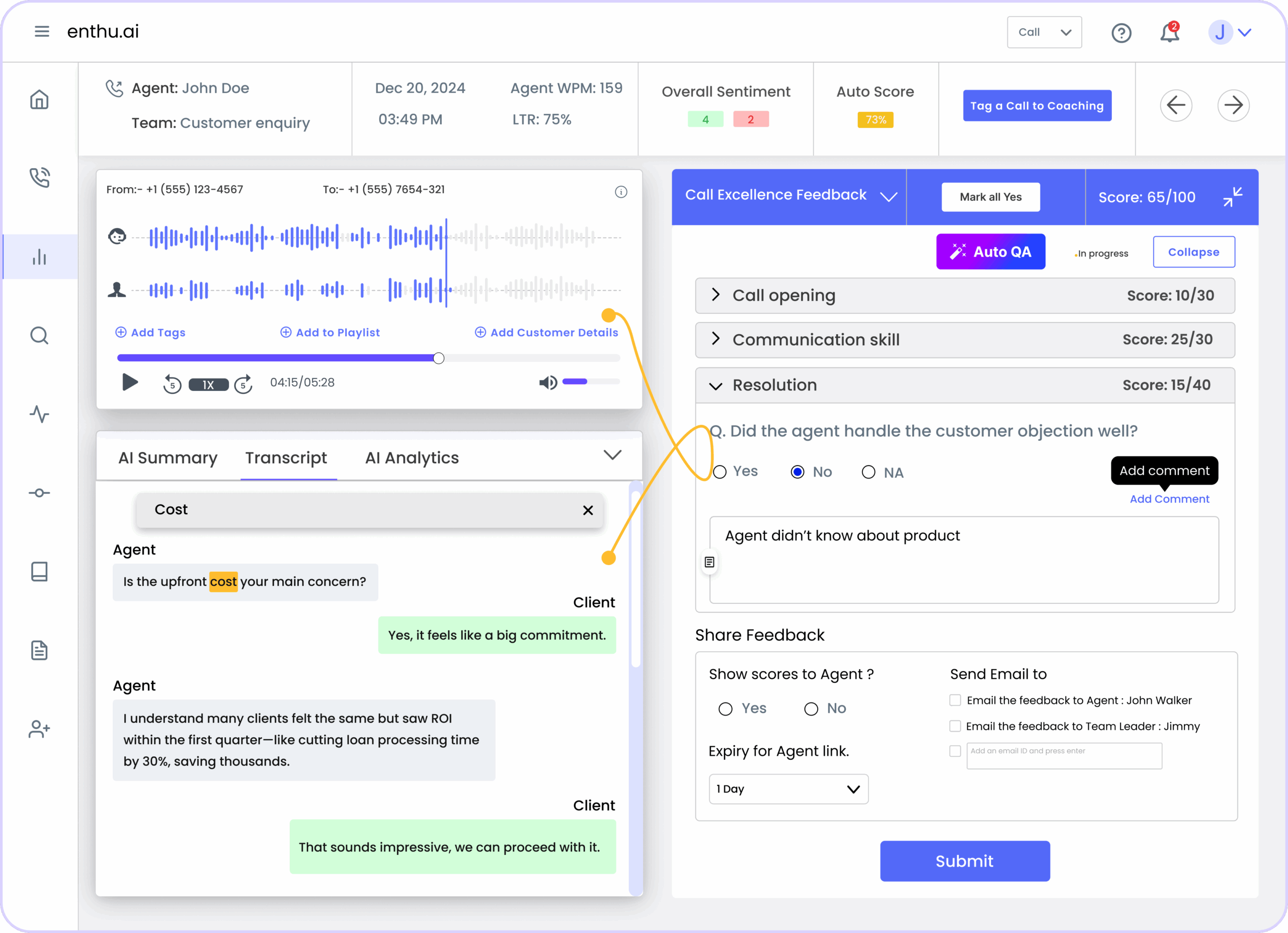

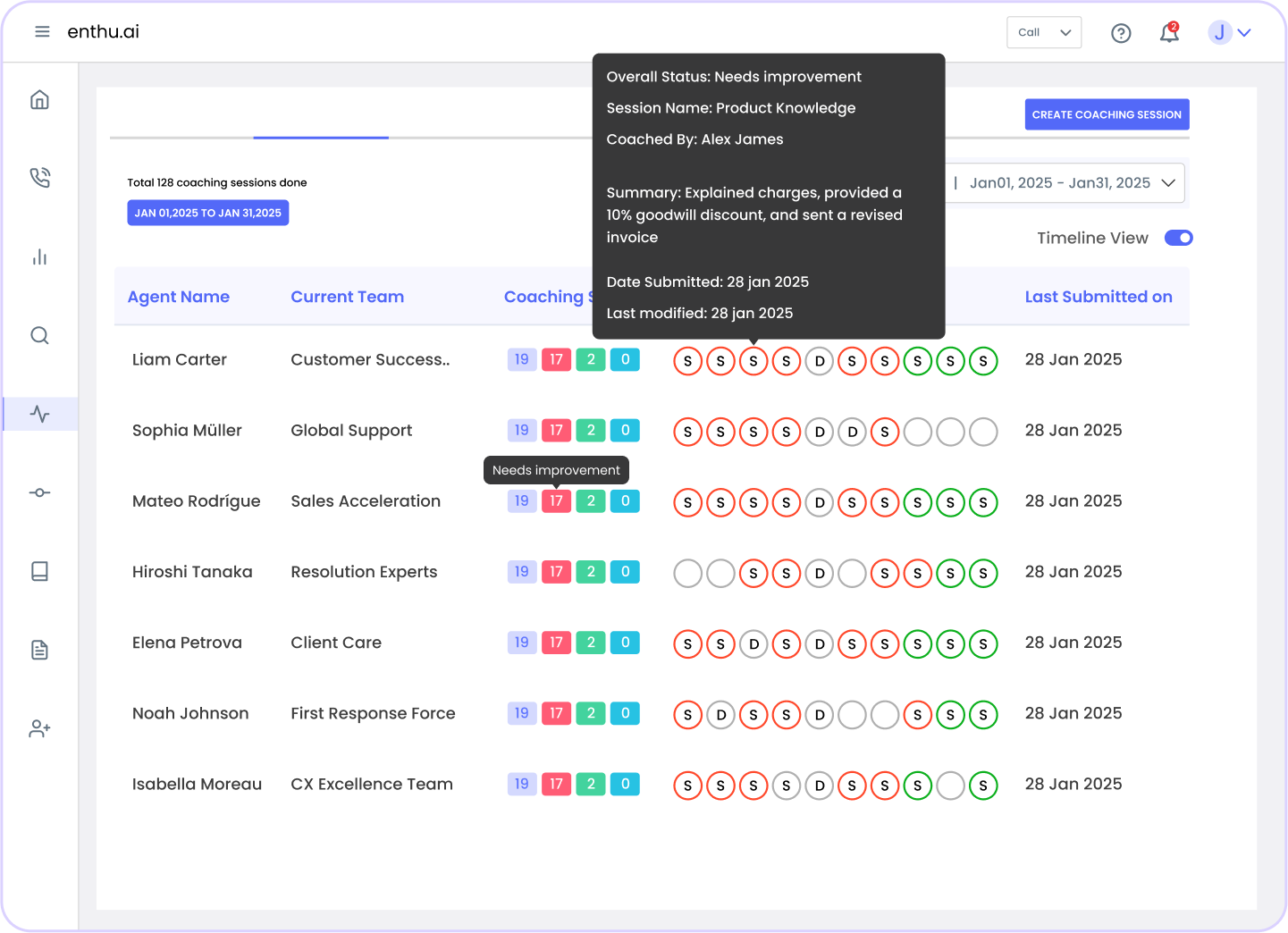

D. Enthu.AI: Most advanced AI-powered solutions for banking call center

Struggling to keep up with the demands of your banking call center?

Enthu.AI offers the most advanced AI-powered solutions to revolutionize your financial operations.

With Enthu.AI, you can enhance compliance, automate quality assurance, and speed up agent training.

Our platform helps boost revenue by identifying top-performing behaviors and improving customer experience by addressing common concerns. Moreover, you can reduce agent attrition by fostering a supportive feedback environment.

Ready to transform your call center?

Conclusion

So, these are the top AI in banking applications that can significantly elevate your banking contact center’s performance.

AI-powered tools can help you streamline operations, enhance customer experience, and stay ahead of the competition by automating routine tasks and providing valuable insights.

Without leveraging these advancements, you risk falling behind in a rapidly evolving industry.

If you need help with AI adoption or need help figuring out where to start, we can help.

With over a decade of experience and successful implementations for numerous banking call centers, we’re here to support you.

Let us know how we can assist you in revolutionizing your call center.

FAQs

1. What is the application of AI in the banking sector?

AI in banking is applied to automate routine tasks, enhance fraud detection, personalize customer experiences, and streamline loan processing. It also helps in risk management, regulatory compliance, and optimizing operational efficiency.

2. How can AI improve customer service in banks?

AI improves customer service by providing 24/7 support through chatbots and virtual assistants, analyzing customer sentiment for tailored responses, and predicting needs for proactive service. It also streamlines repetitive tasks, allowing human agents to focus on complex issues.

3. What are the advantages of AI in banking?

AI in banking offers reduced operational costs by automating tasks, enhanced customer experience with personalized services, improved fraud detection with real-time analysis, and more accurate loan and credit decisions through comprehensive data analysis.

On this page

On this page