“Wait… did they just skip the legal part of the call?”

If you’ve ever managed a call center, you know that feeling.

Running a call center is already a lot—hiring, training, hitting targets.

But when you add compliance (a fancy word for following rules), things can get stressful real fast.

And here’s the thing: most mistakes aren’t big or obvious.

Sometimes, it’s as simple as an agent forgetting to say, “This call is being recorded,” or not asking for permission before sharing a product.

But even small mistakes can lead to big problems—like getting fined or even getting sued.

A report from McKinsey says that companies now spend around 15–20% of their budget just on staying compliant.

That’s huge. But still, many managers don’t really know how to catch problems before it’s too late.

That’s where this article comes in.

Let’s make compliance simple, not scary. Let’s be honest—compliance can feel like a long list of rules nobody wants to read. But skipping even one small step on a call can lead to big trouble. Fines, legal issues, angry customers—you name it. This checklist keeps things simple. If you’re running a call center, these are the boxes you need to tick to stay safe and sound. If you’re running a call center, you need to know the rules of the game. And no, it’s not just one rulebook—it depends on what you do and who you’re talking to. Let’s break it down. These laws change often. So it’s not a one-time study session. You need to stay updated. Let’s say a customer in Germany wants their data deleted under GDPR. If your team doesn’t know what to do or doesn’t act fast, you could face serious fines. What You Can Do: Pro Tip💡 Don’t wait for a lawsuit. Build compliance into your everyday process.

A. The ultimate compliance checklist for call center managers

1. Understand the rules that apply to you

2. Always tell the customer the call is being recorded

“Hi, this call may be recorded for quality and training purposes.”

Sounds familiar? That’s because it’s a legal must in many places.

Some U.S. states follow what’s called “one-party consent,” meaning only one person (usually your agent) needs to know the call is being recorded.

But in states like California, Florida, and Pennsylvania, “two-party consent” laws apply.

That means both the agent and the customer must be told the call is being recorded.

Now, here’s the tricky part—if your call center is in Texas, but you’re talking to a customer in California, you still need to follow California’s laws.

Always play it safe and assume two-party consent.

📞 Example

Let’s say an agent forgets to mention the recording at the start. The customer gets upset later and files a complaint. If you’re in a two-party consent state, that call could cost you thousands in penalties.

What You Can Do:

- Make the recording disclaimer part of your agent’s opening script

- Use system prompts that automatically play the message before the agent joins the call

- Train agents on why this small line is a big deal

Pro Tip💡

Keep it friendly and simple—

“Just a quick heads-up: This call may be recorded to help us serve you better.”

This tiny sentence can save you a mountain of legal trouble.

3. Use scripts that stick to the rules

Your agents are the voice of your company.

And what do they say on a call? It matters—a lot.

That’s why your call scripts should do more than just help agents sound good. They should help you stay compliant.

Scripts are like seatbelts. They don’t guarantee that nothing will go wrong, but they help protect you when it does.

A good script makes sure your agents:

- Disclose call recordings upfront

- Ask for the right permissions, especially when collecting personal data

- Follow the right order of questions, especially in sensitive industries like finance or healthcare

- Avoid risky words or claims that could sound misleading or aggressive

Example:

If you’re running a debt collection call center, your agents can’t promise to remove debt from a credit report if it’s not legally possible. One wrong sentence could get your whole business in trouble.

What you can do:

- Work with your legal or compliance team to review your scripts

- Update scripts regularly as regulations change

- Use call monitoring tools to catch if agents are going off-script

- Role-play scenarios during training to practice sticking to the right language

Pro Tip 💡

Make scripts sound natural. If agents feel like they’re reading a robot manual, they’ll ditch it. A well-written, conversational script can protect your company and make customers feel heard.

You can use spreadsheets to track the process.

Call script compliance checklist (Excel Format)

| Section of the Call | Script Line | Compliance Purpose | Regulation Covered | Last Reviewed | Is It Mandatory? (Y/N) | Agent Feedback |

| Opening | “Hi, this call may be recorded…” | Notify of call recording | TCPA / State Consent Laws | MM/DD/YYYY | Y | Agents comfortable using this line |

| Data Collection | “Can I get your email to send a receipt?” | Permission to collect personal info | GDPR / CCPA | MM/DD/YYYY | Y | Needs simpler wording |

| Payment Info | “Let me transfer you to our secure payment line.” | Avoid storing payment info | PCI-DSS | MM/DD/YYYY | Y | Works well in current flow |

| Health Details | “Can you confirm your insurance provider?” | Protect health data | HIPAA | MM/DD/YYYY | Y | Script revised last quarter |

| Closing | “Would you like a summary of this call emailed to you?” | Offer data access | GDPR / CCPA | MM/DD/YYYY | N | Add checkbox in CRM |

With Enthu.AI, it’s all done automatically

4. Get clear consent before using customer info

When someone gives you their personal info, it’s not a free pass to use it however you want. You need clear permission—every time.

This is called “consent”, and it’s one of the biggest parts of staying compliant. Whether you’re saving a phone number, sending a marketing email, or recording a call, you need to make sure the customer knows and agrees.

Example:

Say your agent collects an email during a support call. You later use that email to send promo offers.

If the customer never agreed to get marketing emails, you’ve just broken the rules.

And this isn’t just about good manners—laws like GDPR, TCPA, and CCPA all require consent in some form.

There are two types of consent:

- Implied consent: When someone gives you their info for a clear reason (like support).

- Express consent: When they clearly say “yes,” usually by checking a box or giving verbal approval.

What You Can Do:

- Ask for permission clearly, and make sure it’s documented

- Avoid pre-ticked checkboxes—they’re not valid under most laws

- Train agents to explain why info is being collected

- Use systems that log consent records in case you ever need proof

Pro Tip💡 Don’t rush through consent. A 5-second pause to ask, “Is it okay if I send you updates?” can save you from thousands in penalties later.5. Record and store calls securely

Recording calls can be super helpful. It lets you review conversations, train agents, and even settle disputes. But here’s the deal: once you hit “record,” you’re responsible for that data.

That means you need to store it safely, protect it from leaks, and know how long you’re allowed to keep it.

Why it matters:

Call recordings often include personal info—names, addresses, payment details, and even health data. If that gets into the wrong hands, you’re not just losing trust—you could face serious fines.

Real example:

In 2019, a UK-based call center was fined for storing unencrypted call recordings that included payment info. They didn’t even know the data was at risk—until it was too late.

What You Can Do:

- Use secure servers with encryption (both when storing and transferring files)

- Limit who has access to recordings—only people who really need it

- Auto-delete old files after the retention period ends (as per GDPR, HIPAA, etc.)

- Monitor for breaches or unauthorized access regularly

Pro Tip💡

If you’re not sure how secure your current system is, ask your IT or compliance team to run an audit. A quick check today can prevent a costly mess tomorrow.

6. Train Agents on Compliance (Again and Again)

Just one quick training when you hire someone? That’s not enough. In call centers, compliance rules change. So should your training.

Think of it like driving. Even if you’ve passed your test, you still need to follow new road rules and signs, right? It’s the same with compliance.

Your agents are the first line of defense. If they mess up—even by accident—it’s your company that pays the price.

Why it matters:

A single line like “I’ll remove your debt today” (when it’s not legally allowed) could cost thousands in fines.

And if agents don’t understand laws like TCPA, HIPAA, or GDPR, they might break them without even knowing.

What You Can Do:

- Make compliance part of onboarding—from day one

- Run refresher sessions every quarter

- Use role-plays and real examples so agents don’t just memorize—they understand

- Test their knowledge with quizzes or checklists

- Track who completed the training and when

Pro Tip:

Don’t make training boring. Mix it up with videos, short games, or real-world call clips. The more engaging it is, the more they’ll remember—and the safer your team will be.

Compliance training tracker 1: Excel

| Agent Name | Role/Team | Last Compliance Training Date | Training Type | Quiz Score (%) | Next Due Date | Trainer Name | Remarks |

| Jane Cooper | Sales | 2025-02-15 | Onboarding | 92 | 2025-05-15 | Alex D. | Excellent participation |

| Tom Rivera | Customer Support | 2025-01-10 | Refresher | 78 | 2025-04-10 | Priya S. | Needs to review TCPA section again |

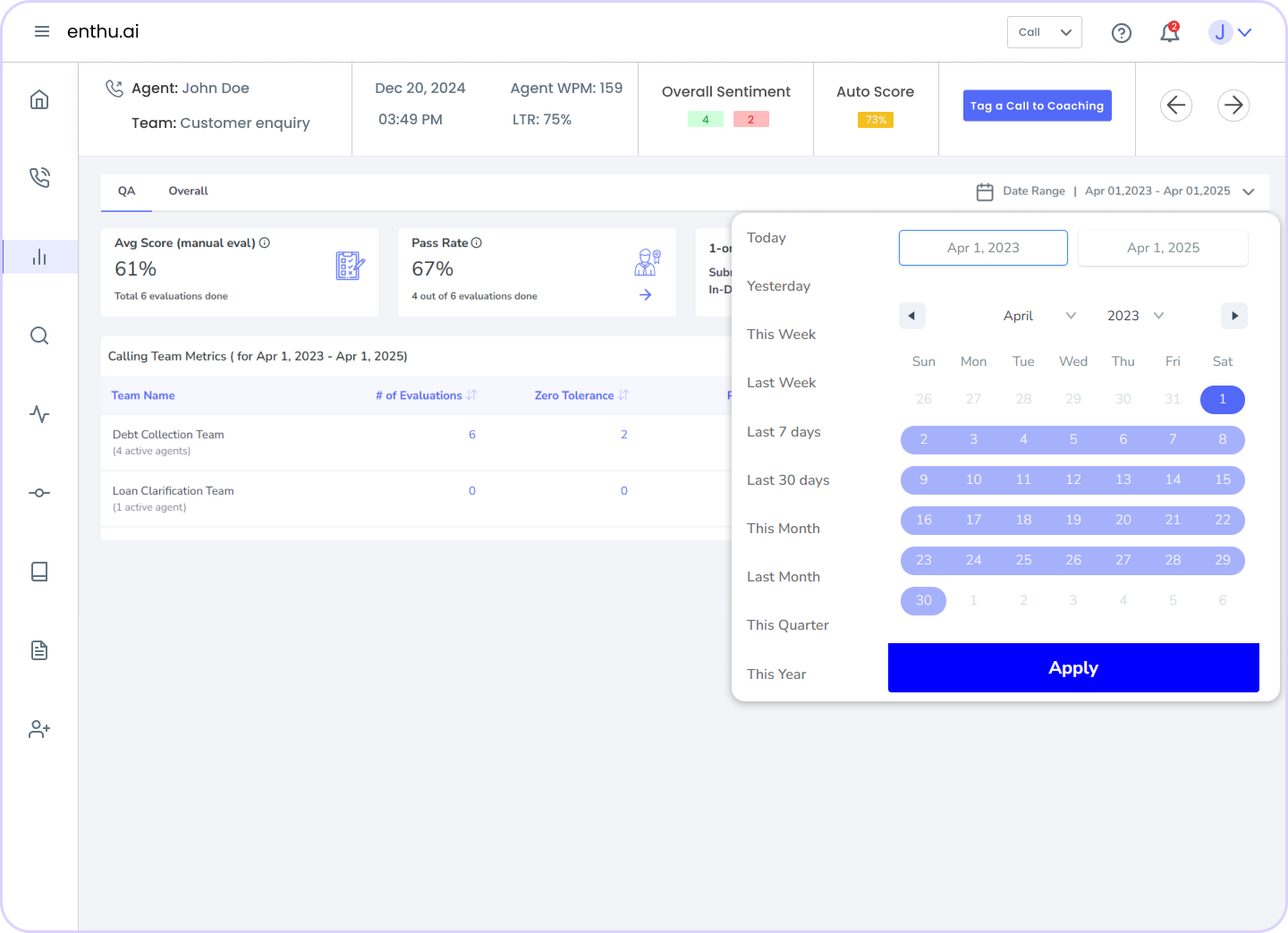

Compliance training tracker 2: Enthu.AI

Add screenshot-coaching session – compliance k around>

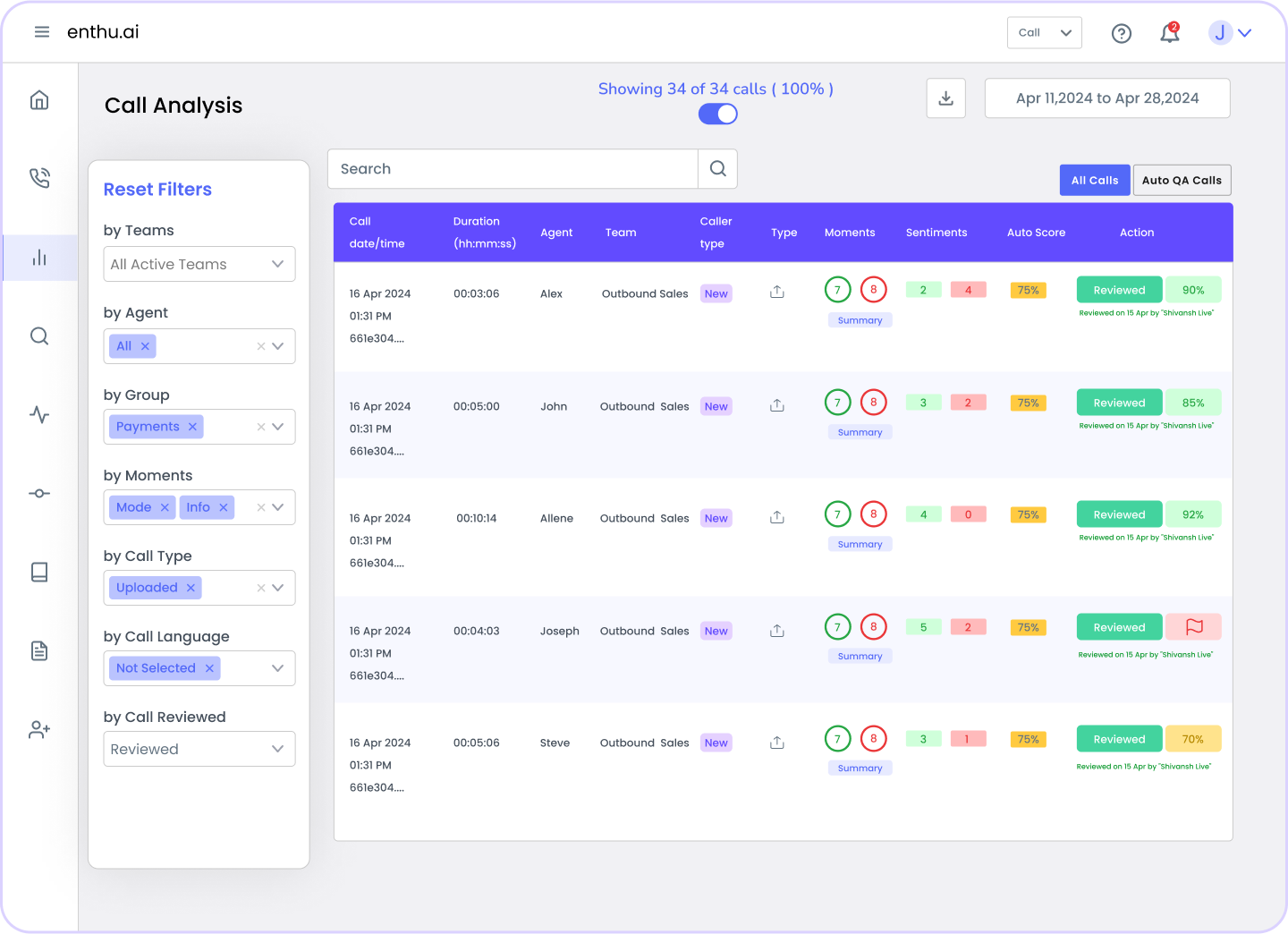

7. Check your calls

You can’t fix what you don’t see. That’s why it’s important to listen to your calls regularly. Mistakes happen—even with well-trained agents. And if no one’s checking, they’ll keep happening.

But here’s the good news: You don’t have to listen to every single call manually. That would take forever.

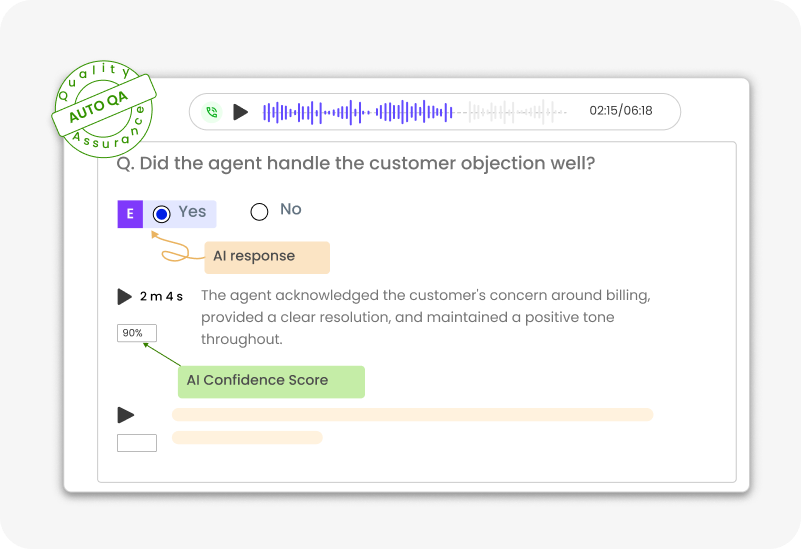

Enter tools like Auto QA. These tools scan every call, flag issues, and show you patterns—fast. Whether it’s a missed disclaimer or a privacy breach, you’ll know early. That means you can fix problems before they become big compliance risks.

Example:

Let’s say your agent forgets to mention that the call is being recorded. If it happens once, it’s a warning. What if it happens 10 times and no one notices? That’s a bigger issue—and possibly a fine.

What You Can Do:

- Use call monitoring tools to review 100% of your calls

- Set alerts for key phrases (like “call recording,” “credit card,” and “unsubscribe”)

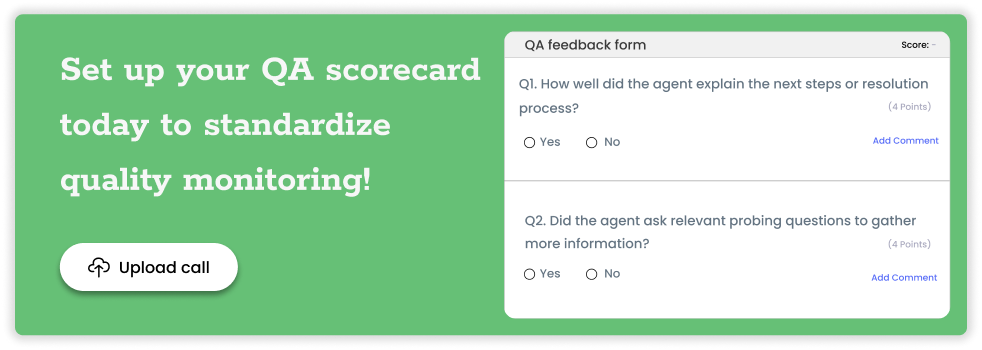

- Create QA scorecards that include compliance checks

- Give regular feedback to agents on what they did right and wrong

Pro Tip💡

Even if you use AI tools, don’t ignore human review. A mix of automation and manual listening gives you the full picture.

👉 Want help building your QA scorecard? We’ve already written a step-by-step guide on how to create a QA scorecard for call centers — don’t miss it.

B. Top 5 Compliance features to look for in call monitoring software

Call monitoring isn’t just about agent performance. It’s also about following the rules. Mess that up, and it can cost you—big time. In 2023, U.S. companies paid over $39 million in fines for privacy violations (FTC).

That’s where the right software helps. It catches problems early. It keeps call data safe. And it shows you who’s sticking to the rules.

As Gartner says, “Compliance isn’t a one-time task.”

In this section, we’ll look at five must-have features. These help you stay compliant, avoid fines, and focus on what matters—your customers.

Let’s dive in.

| Compliance Feature | Why It’s Important | What to Look for in Software |

| Call Recording with Consent Capture | Legal requirements vary by region; protects against lawsuits. | Automatic logging of consent, alerts on missing disclaimers, searchable transcripts. |

| Redaction of Sensitive Data | Prevents exposure of personal data; avoids heavy fines. | Automatic redaction/masking of data in audio and transcript, irreversible redaction features. |

| Automated Keyword & Phrase Detection | Flags compliance risks automatically; saves time. | Custom keyword libraries, AI-driven detection, real-time alerts, or flagging system. |

| Customizable QA Scorecards | Ensures agent actions align with regulations. | Custom compliance metrics, trend tracking, performance scoring with compliance criteria. |

| Secure Audit Trails & Call Logs | Proves accountability and provides legal protection. | Detailed logs of access, actions, timestamps; exportable data for audits and compliance reviews. |

Let’s break this down further:

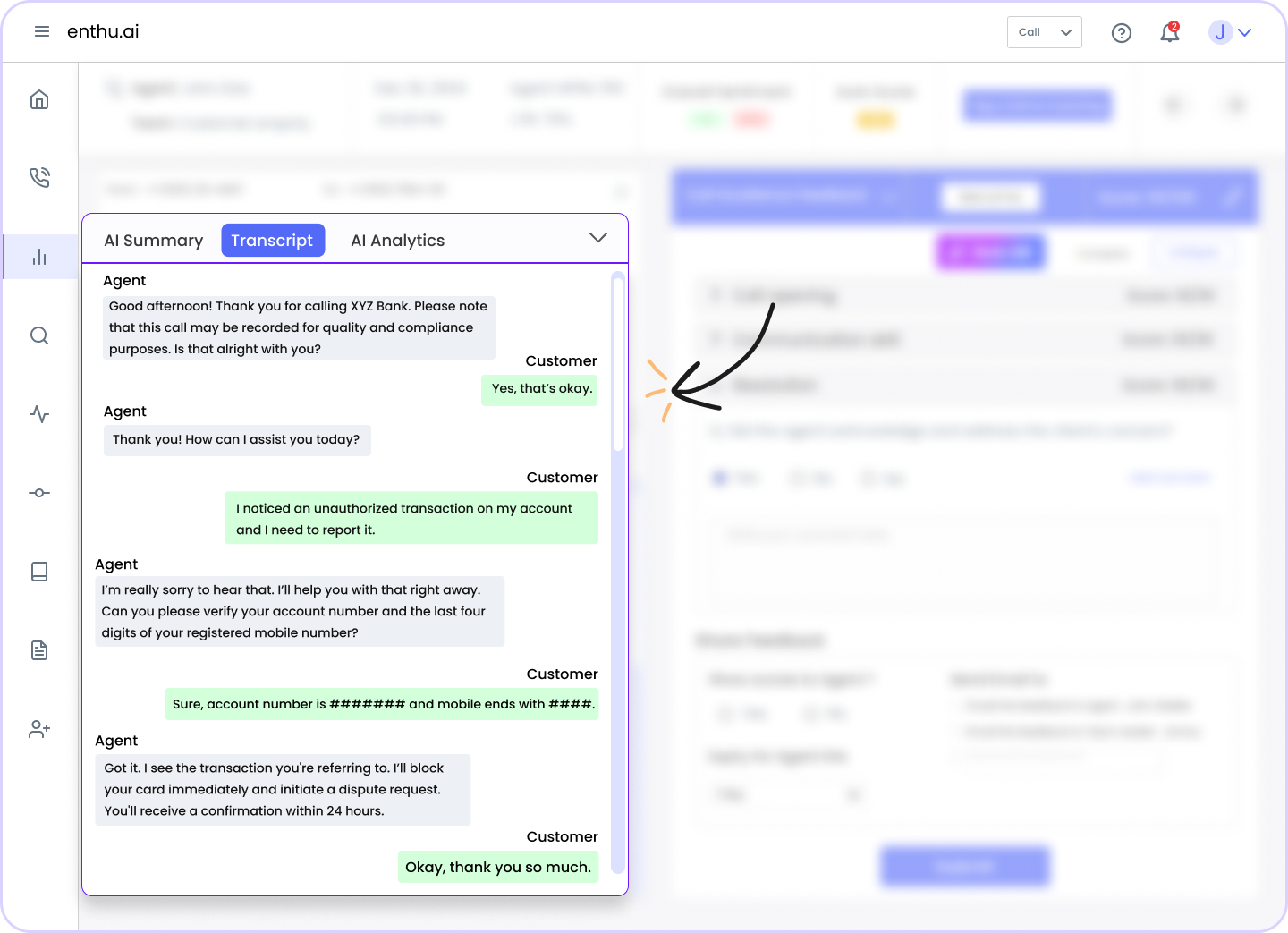

1. Call Recording with Consent Capture

Why it matters:

Recording calls is standard in most call centers, but you can’t just record without permission.

In the U.S., laws differ by state—some states only need one person’s consent, while others need both the agent and the customer to agree.

Example:

Let’s say your agent is calling someone in California (a two-party consent state). If they forget to say, “This call is being recorded,” you could face legal action and fines.

A major telecom company once faced a $25 million penalty because they didn’t follow consent rules.

What your software should do:

- Detect and log the moment consent is given

- Flag calls where agents forget to give a disclaimer

- Auto-tag those calls for QA review

- Provide recorded proof in case of a legal challenge

Best practice:

Train agents to say something like:

“Just a quick note—this call is being recorded for training and quality purposes. Is that okay with you?”

Pro tip💡

Look for software that transcribes calls and highlights consent phrases automatically. Some tools, like Enthu.AI or Observe.AI, even alert supervisors in real time if an agent forgets the consent line.

📚 Research Insight:

A 2023 Gartner report noted that 43% of compliance violations in call centers were related to missing or unclear consent in recordings.

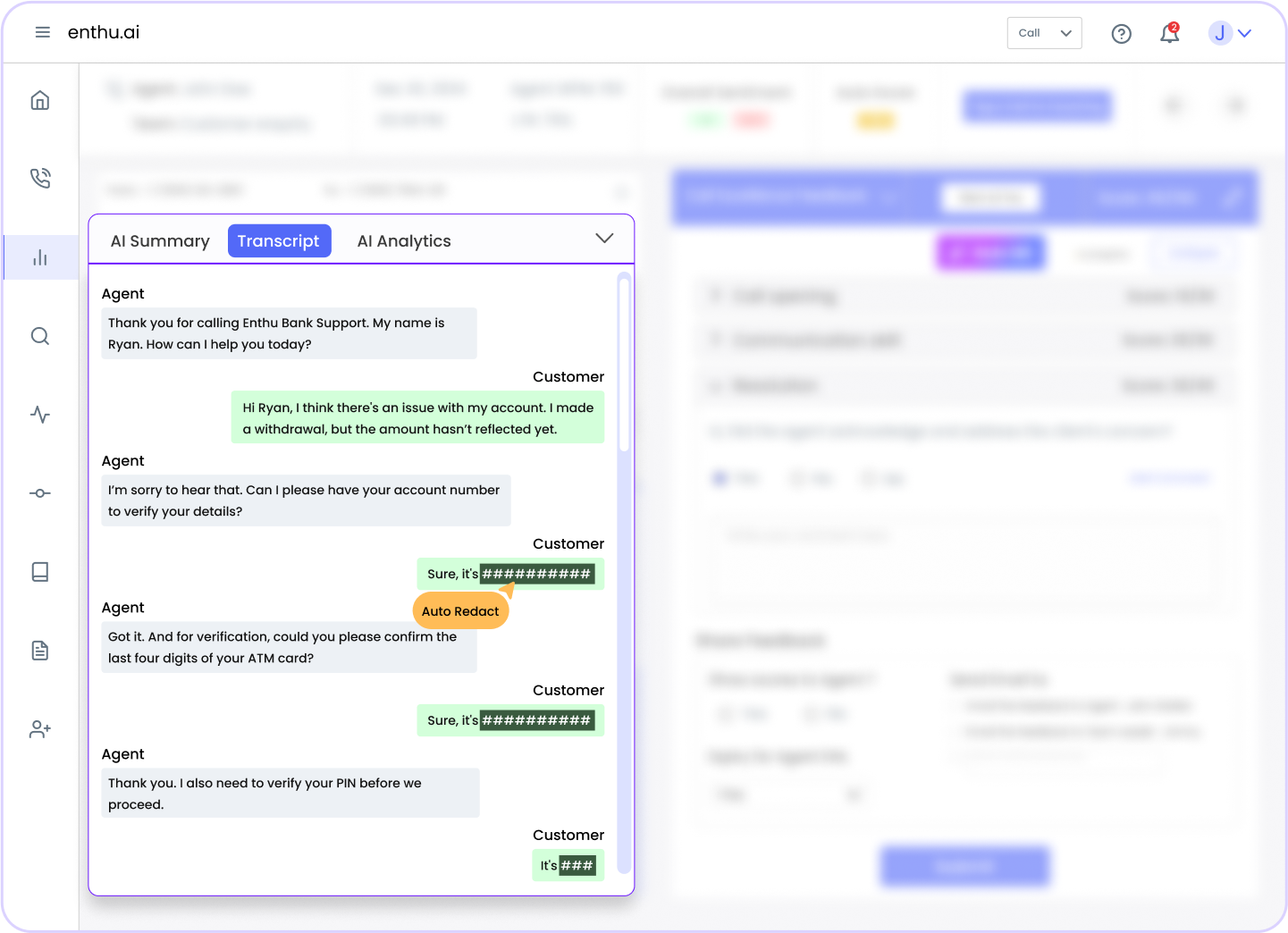

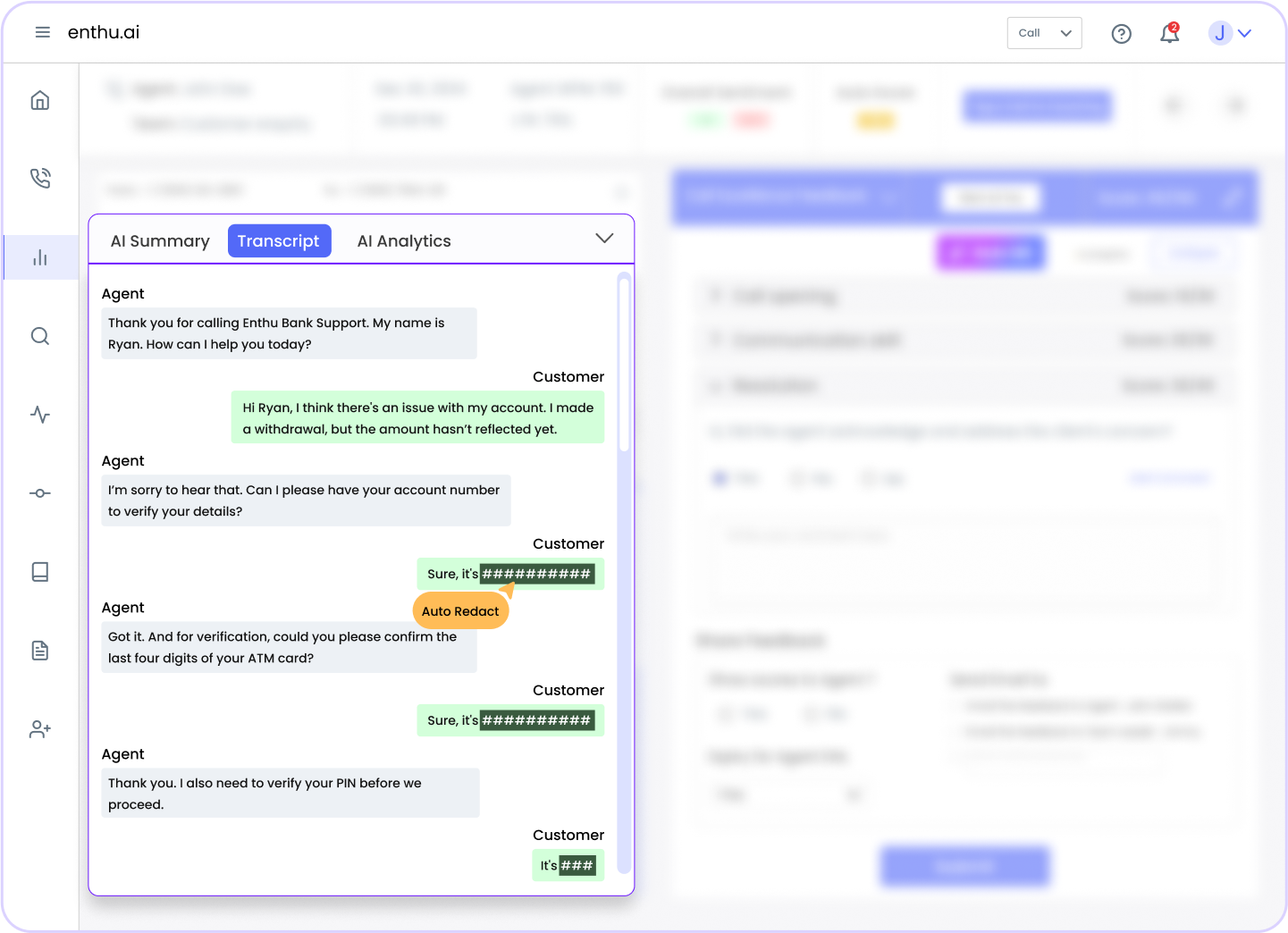

2. Redaction of Sensitive Data

Why it matters:

Customers share personal info over the phone—credit card numbers, medical details, passwords. If that data leaks, your company could face heavy fines and reputation damage.

Example:

In 2020, a U.S. health company was fined $6.85 million after unredacted call recordings were exposed, revealing patient health info and payment details.

What your software should do:

- Identify sensitive words or patterns (e.g., 16-digit card numbers)

- Automatically mute, bleep, or blur that section in the call recording and transcript

- Prevent agents from storing personal data in call notes

Relevant laws:

- PCI-DSS: Payment data security

- HIPAA: Health information privacy

- GDPR/CCPA: Data privacy for EU & California residents

Example:

A customer says: “My card number is 4321 8765 0987 1234.”

A good tool instantly replaces it with: **** **** **** **** in the transcript and mutes the audio.

Pro tip💡

Make sure the redacted data can’t be restored. Some cheap tools just “hide” the data—it’s still there in the backend. That’s a compliance risk.

📚 Research Insight:

According to IBM’s 2022 Cost of a Data Breach Report, the average breach cost in the U.S. healthcare industry was $10.1 million. Redacting sensitive info can massively reduce that risk.

3. Automated Keyword & Phrase Detection

Why it matters:

You can’t manually listen to every call. So how do you make sure agents are saying the right things and not saying the wrong ones? You let your software do it for you.

How it works:

The software scans every call and flags:

- Missing mandatory phrases (“This call is recorded”)

- Risky statements (“We guarantee a return on investment”)

- Legal red flags (“We store your data forever”)

Example:

Let’s say you run a loan company. Agents must say, “Interest rates are subject to approval.” If an agent forgets and says, “You’ll definitely get 5%,” that’s a compliance risk. Your tool can auto-flag that call for review.

Custom use case:

In the healthcare space, you’d want to track phrases like:

- “We are HIPAA-compliant.”

- “Your medical info is private.” In retail, it might be:

- “We don’t sell your personal data.”

Pro tip💡

Get tools that allow custom keyword libraries. Your business is unique—your compliance language should be too.

📚 Research Insight:

A Forrester study found that AI-driven keyword detection helped reduce call center risk exposure by over 35% in high-compliance industries like banking and healthcare.

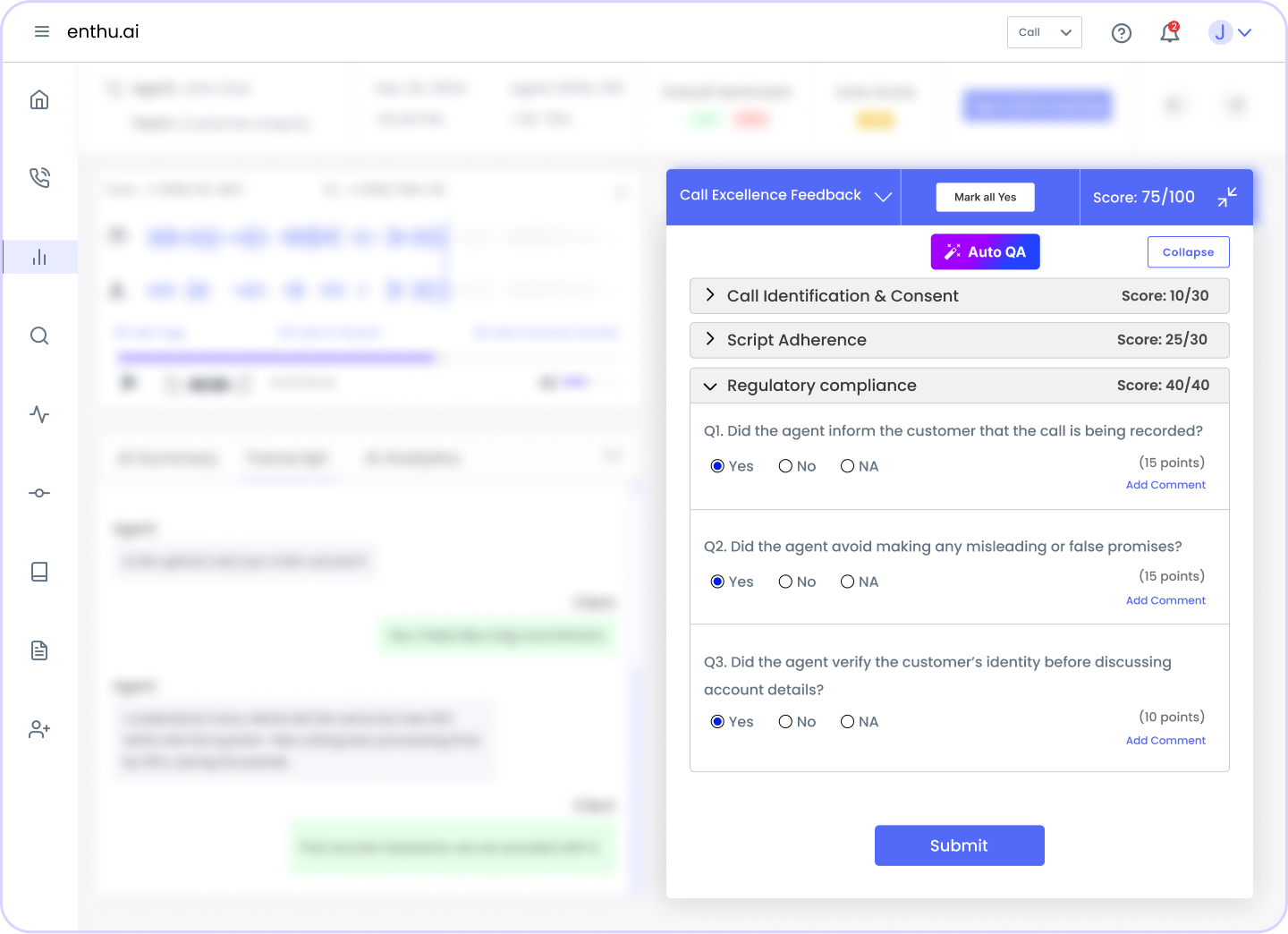

4. Customizable QA Scorecards with Compliance Criteria

Why it matters:

QA scorecards let you rate and review how well agents follow rules and talk to customers. But if your scorecard only checks for “politeness” and “tone,” you’re missing the big stuff—compliance.

What to include:

- Was the customer told the call was being recorded?

- Did the agent avoid making false promises?

- Was sensitive data handled properly?

- Was consent clearly given and logged?

Example:

A BPO serving a healthcare client may include:

- “Confirmed patient identity?”

- “Did NOT disclose diagnosis over voicemail?”

- “Stated HIPAA disclosure terms?”

How software helps:

- Let’s you build custom forms

- Assign scores to compliance actions

- Track trends by agent, team, or campaign

Pro tip💡 Review your scorecards every quarter. Laws change—so should your evaluation criteria.

Research Insight:

McKinsey reported that companies using compliance-focused QA scorecards reduced repeat compliance violations by up to 40% in just six months.

Need help building one? Here’s our full guide to Agent scorecards →

5. Secure Audit Trails & Call Logs

Why it matters:

Sometimes, it’s not just about what was said—it’s about who listened to it, when, and why. That’s what audit trails are for. Think of them as the CCTV footage of your call recordings.

What it should track:

- Who accessed the call recording

- What was edited, flagged, or commented on

- When the call was recorded, reviewed, or downloaded

Example:

Let’s say a regulatory body asks for proof of how your team handled a customer complaint. You can pull up the call and show:

- When it happened

- Who reviewed it

- What was flagged and by whom

Pro tip💡

Pick a tool that stores logs for at least 2–3 years (depending on your industry) and allows easy exports for auditors.

📚 Research Insight:

A Deloitte survey showed that 58% of call centers struggled to provide clean audit trails during compliance investigations—mostly because they used outdated or manual systems.

C. What Happens If You Miss a Compliance Violation? (And How to Catch It Early)

Missing a compliance violation isn’t just a small mistake. It can cost your business a lot of money—and trust.

Let’s say an agent forgets to mention that a call is being recorded. In some states, that’s illegal. And if your company gets caught? You could face fines, lawsuits, or worse—bad press.

In 2023, the FCC fined one company $45 million for breaking robocall rules. One missed detail. One rule is broken. That’s all it takes.

But here’s the thing—these violations are hard to spot manually. Most call centers review just 1-2% of total calls, according to a report by McKinsey.

That means 98% of your calls could go unchecked. Scary, right?

So how do you catch issues early?

Use tools that automatically review all your calls. AI-powered solutions like Auto QA can flag risky behavior—like missing disclaimers, unapproved language, or mishandled customer data.

Create a simple checklist—just like the one we covered earlier.

Make sure every agent follows it. Update it as rules change.

And most importantly—train your team often. Compliance isn’t a “one and done” thing. It’s ongoing. As author Stephen Covey said, “Without involvement, there is no commitment.”

Involve your agents. Review your data. Catch problems early—before they catch you.

D. How to Balance Call Quality & Compliance Without Micromanaging

Quality and compliance. Both matter. But trying to do both—without overwhelming your agents—is tricky.

You want agents to sound human, not like they’re reading from a legal script. At the same time, they need to hit key points, follow rules, and protect customer data.

So, how do you strike that balance?

Start by setting clear expectations, not strict rules. Give agents a framework, not a word-for-word script. Think: “Here’s what you need to say” vs. “Say this exactly.”

Next, use call monitoring tools that work behind the scenes. Auto QA, for example, can scan 100% of calls for risky behavior—without you hovering over every agent.

Instead of correcting every small thing, use call insights to guide team coaching. Highlight what went well. Gently flag what didn’t. Make feedback a two-way conversation.

Also, automate the boring stuff—like tracking disclaimers, pause times, and consent lines. That way, agents can focus on helping the customer—not checking a box.

Lastly, reward smart behavior. If an agent handles a tricky situation and still stays compliant, recognize that. It boosts morale and builds trust.

Compliance shouldn’t kill creativity. With the right tools and mindset, you can have both—happy agents and safe calls.

Conclusion

Contact center compliance is an ongoing commitment that demands attention to detail, effective strategies, and robust tools.

By implementing the outlined checklist and leveraging solutions like conversation intelligence and speech analytics, your call center can navigate compliance challenges confidently.

Protecting customer data and adhering to regulations not only avoids penalties but also builds trust, ensuring long-term success.

Compliance is not just a legal obligation; it is a cornerstone of sustainable and ethical business practices.

FAQs

1. What is call center compliance?

Compliance in a call center refers to adhering to laws, regulations, and organizational policies during customer interactions. It ensures agents follow protocols such as data protection, consent, and accurate communication to safeguard the company’s reputation and avoid legal risks.

2. What are the 5 points of compliance?

- Data Privacy: Protect customer data as per regulations like GDPR or CCPA.

- Call Recording Consent: Inform and obtain customer consent before recording calls.

- Regulatory Adherence: Follow laws like TCPA, PCI-DSS, or industry-specific standards.

- Truthful Communication: Ensure accurate and honest information is shared with customers.

- Complaint Handling: Address customer complaints within stipulated timelines.

3. What is a good example of call center compliance?

An example of call center compliance is ensuring agents follow PCI-DSS guidelines during payment processing. This includes masking sensitive credit card details during calls and using secure systems to handle transactions, protecting both the customer and the business.

On this page

On this page