In today’s fast-paced world, customer expectations are higher than ever. Customers want quick, personalized, and effective support at any time of day. For many support teams, this can feel like an impossible challenge. Traditional methods just can’t keep up with the demand for speed and personalization while maintaining quality.

That’s where AI in customer service comes in. AI is no longer a futuristic concept; it’s a vital tool that can help you meet these rising demands. This guide will walk you through how AI can transform your support operations, what benefits it brings, and how to get started on your own AI journey.

Why AI Matters in Customer Service

The old way of doing support relying solely on human agents is being challenged. Customers expect instant answers and a smooth experience, regardless of the channel they choose. AI helps bridge the gap between efficiency and empathy.

AI doesn’t just automate tasks; it provides powerful insights. For QA managers, support leaders, and CX leaders, AI-powered solutions offer a new level of data-driven decision-making. You can move beyond guesswork and use concrete data to improve your team’s performance and the overall customer experience.

Case Study in Action: Camping World and IBM

When Camping World, a major outdoor retailer, saw a surge in customer calls, its call center was overwhelmed. Calls were being missed, and customers were left waiting.

They implemented an AI assistant named “Arvee,” which could handle calls 24/7. Arvee answered common questions and captured crucial data from every interaction. The results were dramatic:

- A 33-second drop in average wait times.

- A 33% increase in agent efficiency, as agents were freed from repetitive questions.

- A 40% increase in customer engagement, as customers were able to get instant help.

This case shows how AI contact center solutions can work as a partner, not a replacement, to make your support team more effective and your customers happier.

Benefits of Using AI in Customer Service

Implementing AI into your support strategy can deliver significant benefits across your entire organization.

- Faster Response Times: Chatbots and virtual agents can handle a large volume of common questions instantly. This frees up your human agents to focus on more complex, high-value conversations.

- 24/7 Availability: AI-powered tools provide around-the-clock support, meeting the needs of a global customer base without the need to increase headcount for night and weekend shifts.

- Consistency and Accuracy: AI ensures every customer receives a consistent, accurate response. This reduces human error and provides a uniform experience across all support channels.

- Scalable Quality Assurance: Imagine monitoring 100% of your conversations instead of a random sample. AI-driven QA automatically analyzes every interaction, providing a complete picture of your team’s performance and customer satisfaction.

- Cost Reduction: By automating repetitive tasks and improving efficiency, you can handle more inquiries with fewer resources. This allows your team to grow without a proportional increase in costs.

- Smarter Insights: AI contact center solutions analyze vast amounts of data to spot trends, identify customer pain points, and uncover agent coaching opportunities you might otherwise miss.

Examples of AI in Customer Service

AI is already at work in many support teams today, and its capabilities are more advanced than ever. Here are updated examples and recent trends:

- Chatbots & Virtual Assistants: While they still handle high-volume, repetitive queries, modern chatbots, especially those powered by Generative AI, can provide more human-like, conversational, and personalized interactions. They can resolve up to 70% of routine inquiries, significantly reducing the workload on human agents.

- AI Call Summarization: AI-powered summarization is now a standard feature in many contact centers. It goes beyond simple summaries by using Natural Language Processing (NLP) to identify key points, action items, and sentiment cues in real time. This drastically reduces after-call work, with some data suggesting a 35% time savings for agents.

- Sentiment Analysis: AI sentiment analysis has become more sophisticated, moving beyond detecting a customer’s tone and emotion. It can act as an “early-warning churn radar” by analyzing sentiment trends over time across all channels. This allows companies to proactively identify at-risk customers and intervene before they leave.

- Routing and Triaging: AI-powered routing has evolved to be more precise and unbiased. By analyzing factors like the ticket’s language, urgency, and even customer sentiment, AI can route tickets to the most qualified agent in a matter of seconds. This not only speeds up the process but also ensures the right agent is assigned to the right problem, improving first-call resolution rates.

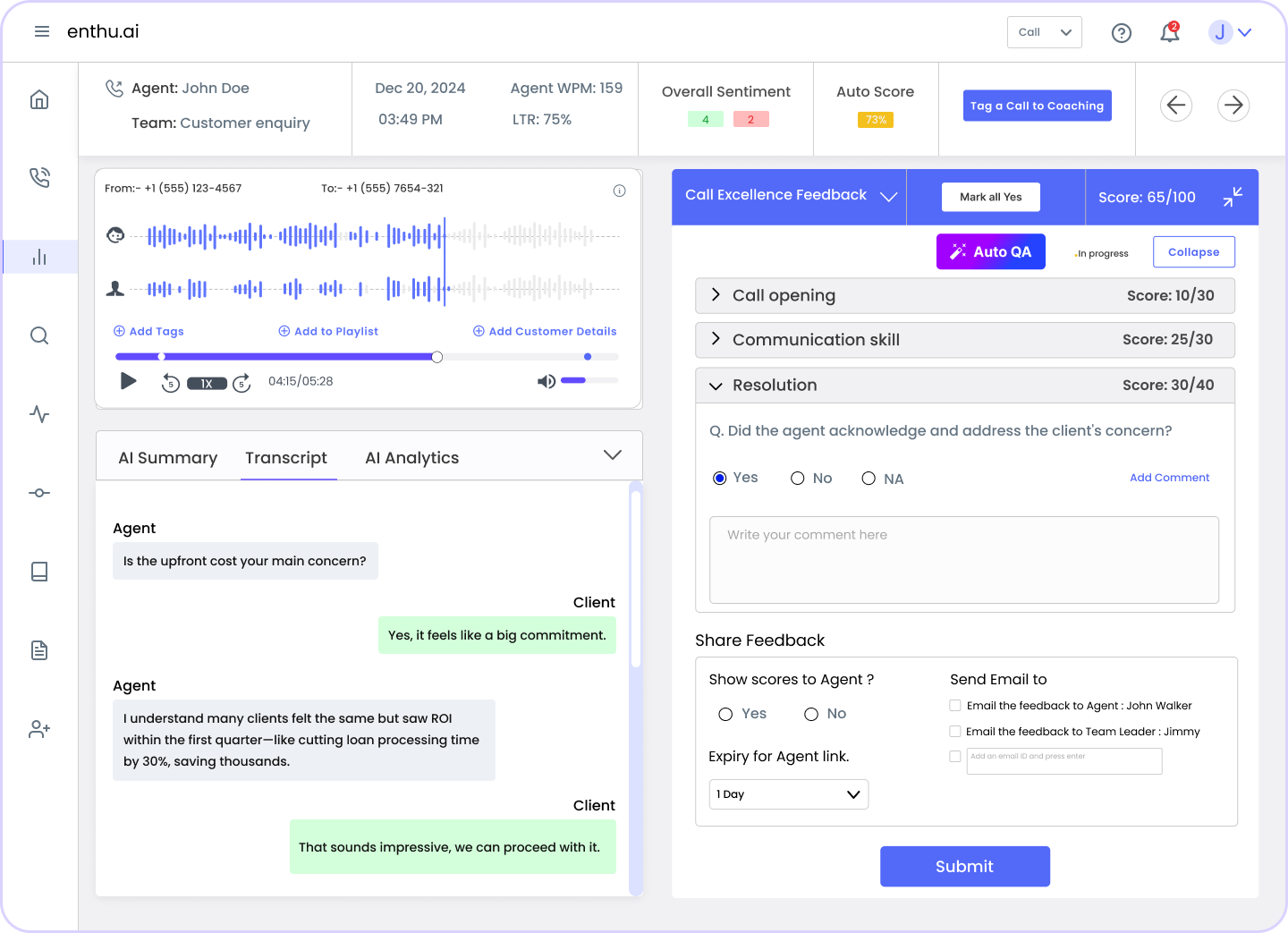

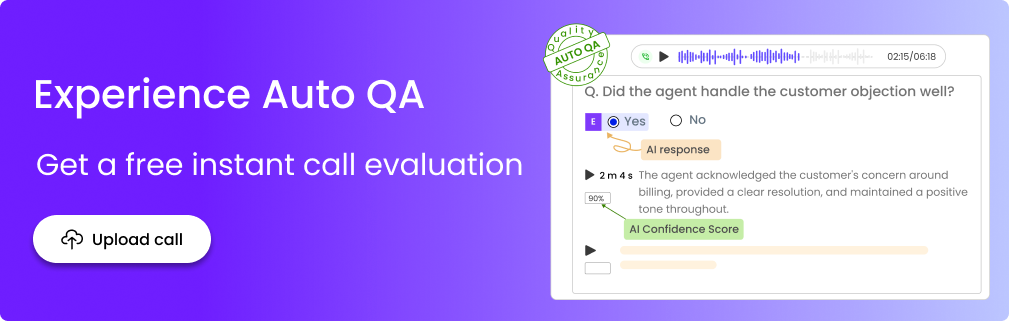

- Auto QA (Quality Assurance) The concept of “Auto QA” is no longer just about sampling. AI-powered quality assurance can evaluate 100% of all customer interactions across every channel (calls, chats, emails). It objectively scores interactions against pre-defined scorecards, identifies winning sales behaviors, and pinpoints coaching opportunities.

Can AI Replace the Customer Service Agent?

This is a common fear, but it’s a misconception. The reality is, AI augments, it doesn’t replace. While AI is excellent at handling data and repetitive tasks, customers still crave human empathy, judgment, and creativity.

The future of customer service is a hybrid model – a seamless collaboration between AI and humans. AI handles the mundane tasks, freeing up agents to focus on complex, high-stakes issues. This allows agents to provide a more meaningful and empathetic experience. The human touch remains irreplaceable, especially for building relationships and solving truly unique problems.

How to Get Started with AI in Customer Service?

Ready to take the first step? It can seem overwhelming, but a gradual approach is best.

- Identify Pain Points: Start by pinpointing your biggest challenges. Is it slow response times, low QA coverage, or high operational costs?

- Start Small with Pilots: Don’t try to do everything at once. Begin with a small pilot program for a single channel or function, like a chatbot for your FAQs or an AI QA solution for your call center.

- Measure Outcomes: Before you scale, measure the impact of your pilot. Look at metrics like improved response time, higher CSAT scores, or increased QA efficiency.

- Scale Gradually: Once you see positive results, you can start to expand your use of AI to more channels and functions.

- Build Trust Internally: Show your agents how AI is a tool to help them, not a threat to their jobs. Highlight how it will reduce their workload and allow them to focus on more rewarding parts of their role.

When choosing a vendor, look for a solution that is accurate, has seamless integrations with your existing systems, and provides clear, actionable reporting.

Conclusion

Artificial intelligence in customer support is a powerful tool to elevate service and empower your team. It’s not about replacing human connection; it’s about enhancing it.

By automating the routine and providing valuable insights, AI allows you to provide faster, smarter, and more personal support than ever before.

Our solutions are designed to help QA managers and CX leaders safely and effectively adopt AI, ensuring you get the benefits of automation without losing the human touch.

FAQs

1. What is AI in customer service?

AI in customer service refers to the use of chatbots, virtual assistants, and AI analytics to automate responses, boost efficiency, and improve customer experience.

2. How are startups using AI in customer service today?

AI isn’t replacing agents, it’s helping them move faster. Most startups use AI for repetitive tasks like tagging tickets, answering FAQs, or summarizing chats. Some use it to detect intent or suggest the right article from the knowledge base. The goal isn’t full automation, but smarter assistance that keeps support teams focused on what really matters complex customer needs.

2. What are the biggest challenges with implementing AI in support?

Reddit users were honest about the roadblocks. Messy data, AI hallucinations, and clunky integrations top the list. Many teams also struggle to make AI sound human and stay on-brand. The takeaway? Success depends less on fancy models and more on clean data, guardrails, and human supervision.

4. Does AI actually reduce support costs?

Eventually yes. But not overnight. The setup and fine-tuning take time. Once you train the model and integrate it well, AI can cut handle times, speed up resolutions, and improve productivity. Most teams see real ROI within 6–12 months after rollout.

5. How do customers feel about AI-driven interactions?

Mixed feelings all around. Some love the quick answers. Others hate the robotic tone. The trick is transparency; let customers know they’re talking to a virtual assistant, and make it easy to reach a human anytime. That balance keeps satisfaction scores high while still saving time.

6. What’s the best way to introduce AI into customer service?

Start small and safe. Begin with low-risk, high-volume tasks like order updates or ticket routing. Track how it affects response time and CSAT before scaling. As your team gets comfortable, expand AI’s role into areas like QA automation or real-time coaching. Think of it as evolution, not revolution.

On this page

On this page