Summary

FCA compliance monitoring has evolved from a tick-box exercise to a strategic necessity. With 130 open enforcement cases and £186 million in fines issued in 2024/25, the stakes have never been higher. The Consumer Duty now sits at the center of regulation through 2030, demanding evidence-based outcomes monitoring across all customer touchpoints. This guide walks you through what FCA compliance monitoring really means, why it matters more than ever, and how to build a risk-based monitoring plan that protects your firm and serves your customers.

Are you confident your firm can prove every customer interaction delivers good outcomes?

The FCA has shifted its focus dramatically.

The regulator no longer simply detects failures after they happen. It now expects firms to prevent harm before it occurs.

This transformation makes compliance monitoring your first line of defense.

It’s not about satisfying auditors anymore. It’s about operational resilience and consumer trust.

The Consumer Duty, fully implemented since July 2024, has made this crystal clear.

You must demonstrate that your monitoring systems actively track customer outcomes in real time.

This article will show you exactly how to do that.

You’ll learn what FCA compliance monitoring truly involves, why it’s become mission-critical, and how to structure a robust, risk-based monitoring plan.

A. What is FCA compliance monitoring?

FCA compliance monitoring is the ongoing, systematic assessment of your business activities against the FCA Handbook and statutory obligations. The objective is to ensure your company prioritizes customer protection, market integrity, and competition.

It’s proactive rather than reactive.

Your monitoring framework should continuously evaluate whether your firm meets regulatory standards across governance, conduct, operations, and customer outcomes.

Here’s what effective monitoring includes:

- Regular testing of controls and procedures

- Real-time tracking of customer outcomes data

- Systematic review of SM&CR responsibilities

- Continuous assessment of financial crime controls

- Proactive identification of compliance gaps

The FCA expects you to use data-driven insights to spot trends, identify emerging risks, and take corrective action quickly.

It helps you catch issues before they escalate into regulatory breaches, customer harm, or reputational damage.

The key difference from traditional compliance? You’re measuring outcomes, not just processes.

B. Why FCA compliance monitoring matters more than ever?

Understanding the stakes helps you prioritize your compliance strategy effectively. Here are some of the important of FCA compliance monitoring:

1. The regulatory landscape has changed

The FCA closed 81 enforcement operations in 2024/25, up from 60 the previous year. Total fines reached £186.4 million, a 337% increase from 2023/24.

These numbers tell a story. The regulator is moving faster and hitting harder.

Consumer Duty remains the centerpiece of FCA regulation through 2030. The bar keeps rising.

The focus has shifted from implementation to evidence.

Your firm must now prove customers receive fair value, clear communication, and appropriate support throughout their journey.

2. Four critical regulatory focus areas for 2025/26

The FCA is conducting four cross-cutting, multi-firm reviews :

- Products and services: The FCA evaluates how you design products to meet customer needs, especially for vulnerable consumers. One protection broker recently simplified disclosure scripts after testing revealed confusion among vulnerable customers.

- Outcomes monitoring: The regulator assesses how you collect and use management information to measure customer outcomes. This covers all four Consumer Duty areas: products and services, price and value, consumer understanding, and customer support.

- Customer journey design: The FCA reviews how you identify and remove friction points that disadvantage less-engaged or vulnerable consumers.

- Consumer understanding: The regulator tests whether your communications genuinely support informed decisions, especially around exclusions, costs, and promotional offers.

3. The cost of non-compliance

Beyond financial penalties, poor compliance monitoring creates serious risks :

- Reputational damage that erodes customer trust

- Loss of authorization or activity restrictions

- Personal accountability consequences under SM&CR

- Increased supervisory intensity and costs

Contact centers face particularly high FCA compliance risk. Financial service firms reported 1.78 million complaints to the FCA in H2 2024. The Financial Ombudsman Service received 305,726 new complaints in 2024/25, the highest in six years.

Your call center sits at the front line of those journeys.

C. Common challenges in FCA compliance monitoring

Even well-resourced firms struggle with these persistent obstacles. Here are the key challenges:

1. Data quality and integration issues

Most firms struggle to collect meaningful outcomes data.

You may have data silos across departments. Your systems might not talk to each other.

The FCA’s Sheldon Mills said it clearly: “Firms need to get serious about their data and not assume they can just repackage existing information“.

2. Resource constraints

Compliance teams often lack the bandwidth to monitor 100% of customer interactions.

Traditional manual monitoring typically covers only 2-5% of calls.

This creates blind spots. Hidden compliance breaches can lurk in the 95% you’re not reviewing.

3. Defining “good outcomes”

Many firms find it difficult to articulate what a good outcome looks like for their specific products.

Without clear definitions, you can’t measure effectively.

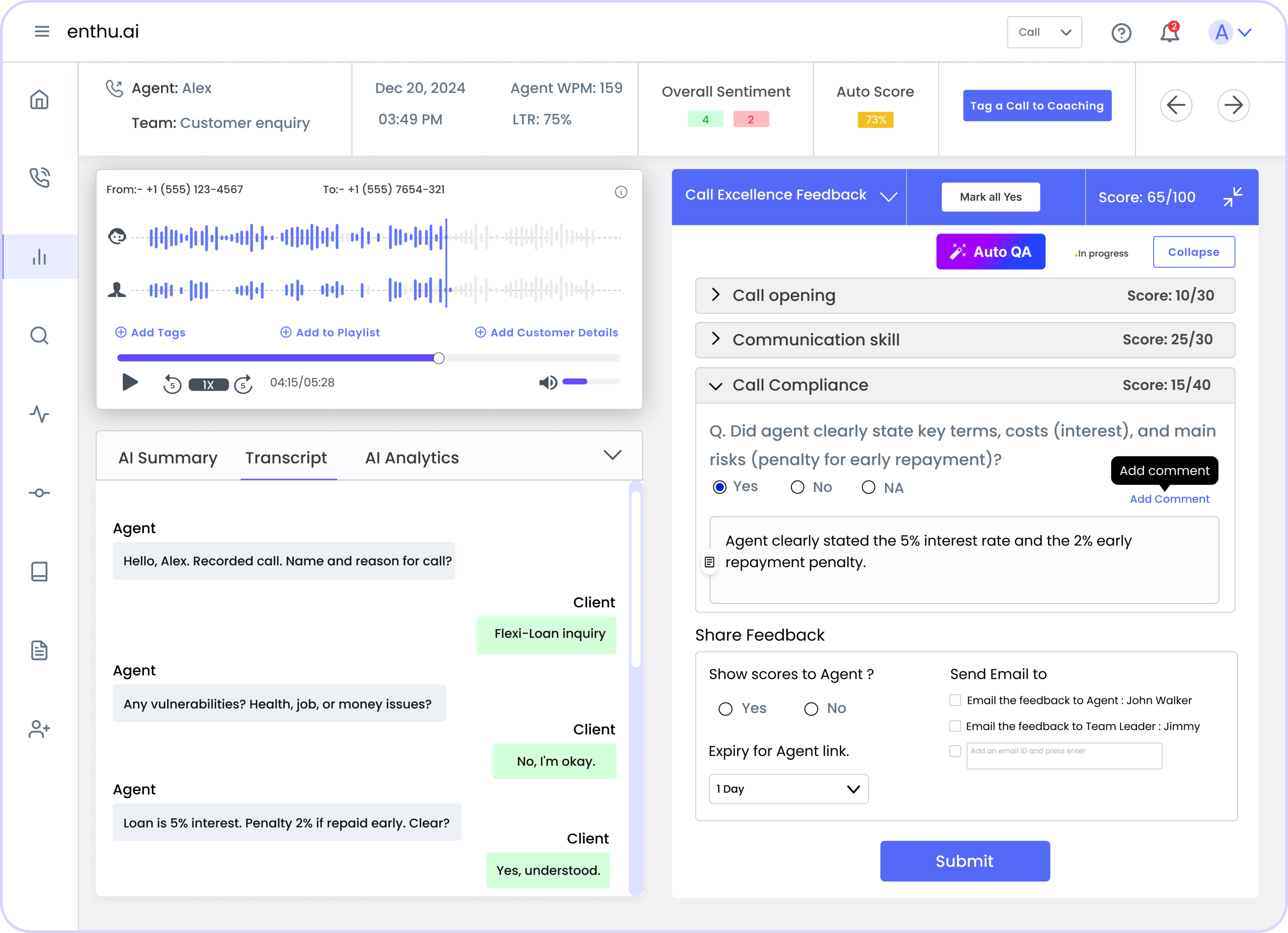

“The biggest gap we see is firms knowing they need to deliver good outcomes but struggling to define what ‘good’ actually means in every customer conversation,” says Tushar Jain, Founder of Enthu.AI. “You can’t improve what you can’t measure.”

4. Balancing speed with thoroughness

The FCA wants evidence of swift corrective action when poor outcomes emerge.

But a thorough investigation takes time. You must balance speed with quality.

5. Legacy systems and closed book monitoring

Supervisory activity in 2025/26 increasingly focuses on closed books and legacy products.

Your older systems may not support modern data extraction.

6. Cultural resistance

Embedding a proactive compliance culture across dispersed or hybrid teams remains challenging.

Some staff view compliance as a burden rather than a protection.

D. How to structure a robust, risk-based FCA monitoring plan?

Building an effective monitoring framework requires a systematic approach. Here are the eight essential steps:

Step 1: Identify your important business services

Start by mapping your critical activities and customer touchpoints. Which services, if disrupted, would cause the most harm to customers or markets?

This forms the foundation of your risk-based approach.

Step 2: Define good outcomes for each product

Work with product owners to articulate what “good outcomes” mean for each product type. Be specific. Use measurable criteria.

For example, a good outcome for a protection insurance product might include:

- Customer understands what’s covered and excluded

- Customers can make a claim easily when needed

- Claims are paid fairly and promptly

- Premium represents fair value for the cover provided

Step 3: Map data sources to outcomes

Identify what data you need to track each outcome. Deloitte analyzed 36 FCA Duty-related publications and identified key data themes firms should monitor.

These include:

- Complaints data segmented by product and issue type

- Call quality and compliance metrics

- Customer satisfaction and Net Promoter Scores

- Persistency rates and early cancellations

- Claims ratios and turnaround times

- Pricing reviews against benchmarks

Step 4: Establish monitoring frequency and triggers

Not everything needs daily monitoring. Use a risk-based approach.

High-risk activities need continuous monitoring. Lower-risk areas might use monthly or quarterly reviews.

Set clear triggers for escalation. Define thresholds that demand immediate investigation.

Step 5: Assign clear accountability

Your SM&CR Statements of Responsibilities must clearly reflect monitoring duties. Senior managers need specific accountability for outcomes monitoring.

The FCA has proposed SM&CR reforms to streamline requirements, but accountability remains central.

Step 6: Implement technology solutions

Manual monitoring can’t scale to 100% coverage. AI-driven compliance monitoring software can review every customer interaction.

These tools identify compliance breaches in real time and send instant alerts. They also produce the evidence regulators demand.

Contact center compliance monitoring software can flag:

- Missing mandatory disclosures

- Vulnerable customer indicators

- Pushy sales tactics or unsuitable advice

- Non-compliant language or promises

Step 7: Create board-level reporting

Your board needs clear, actionable MI on customer outcomes. The FCA reviewed board reports from 180 firms and published good practice guidance.

Effective board reports should:

- Summarize outcomes across all four Consumer Duty areas

- Highlight trends and emerging issues

- Document actions taken to address poor outcomes

- Evidence of how the firm tested its conclusions

Step 8: Build in continuous improvement

Compliance monitoring isn’t static. Regulations evolve. Customers need change. New risks emerge.

Build regular reviews into your plan. Update your monitoring criteria as the FCA issues new guidance.

E. FCA compliance monitoring example: the ‘price and value’ outcome

Let’s make this practical with a real example.

The requirement

Under Consumer Duty, you must ensure products represent fair value. This means the price customers pay is reasonable relative to the benefits they receive.

Monitoring approach

1. Define the Outcome: Your product provides fair value when the total price (including all fees) is reasonable compared to similar products, considering the quality and limitations of the product.

2. Identify data sources:

- Competitor pricing data

- Claims ratios or product utilization rates

- Customer feedback on value perception

- Profitability analysis by product

- Distribution costs and margin analysis

3. Set Monitoring Frequency: Quarterly comprehensive reviews, with monthly checks on key indicators.

4. Establish Triggers: Investigate immediately if:

- Your price exceeds competitors by more than 15% without clear justification

- Customer complaints about value increase by 20% quarter-over-quarter

- Claims ratios drop below a defined threshold

- Cancellation rates spike in the first 12 months

5. Assign Accountability: Your Chief Risk Officer owns the fair value framework. Product owners monitor their specific products.

6. Board Reporting: Present a quarterly fair value dashboard showing price positioning, customer feedback trends, and actions taken to address gaps.

This structured approach gives you clear evidence that you’re actively monitoring and delivering fair value.

F. FCA compliance monitoring checklist (Quick Reference)

Use this table to ensure you’re covering all critical compliance areas. Here are the essential items to monitor:

| Area of Compliance | Checklist Item | Focus (Underlying Regulation) |

| Governance | Are all SM&CR Statements of Responsibilities up-to-date and accurately reflecting current roles? | SM&CR, SYSC |

| Training | Have all staff completed mandatory Conduct Rules training within the last 12 months? | SYSC, COCON |

| Financial Crime | Are adverse media screening results reviewed and documented immediately for high-risk clients? | MLRs, FCG |

| Client Assets | Is client money reconciliation performed daily and signed off by a responsible individual? | CASS |

| Consumer Duty | Are all financial promotions clear, fair, and not misleading, and aligned with the target market? | COBS, CONC, Consumer Duty |

| Complaints | Is root-cause analysis performed on every recurring complaint category? | DISP |

| Outsourcing | Is due diligence and ongoing monitoring of all third-party suppliers documented? | SYSC, Operational Resilience |

| Call Quality | Are 100% of regulated calls monitored for compliance breaches and vulnerable customer indicators? | Consumer Duty, COBS |

| Outcomes Data | Do you collect and analyze MI across all four Consumer Duty outcomes monthly? | Consumer Duty |

| Board Oversight | Does the board receive comprehensive outcomes monitoring reports quarterly with clear actions? | Consumer Duty, SYSC |

G. The Role of technology in FCA compliance monitoring

Modern compliance demands modern tools that can scale to meet regulatory expectations. Here’s how technology transforms monitoring:

1. AI and machine learning

The FCA is actively gathering insights on algorithmic decision-making and ethical AI deployment. But AI also solves a critical compliance challenge.

AI-powered monitoring software can review 100% of customer interactions. Traditional methods cover only 2-5%.

This technology identifies:

- Missing mandatory disclosures in real time

- Language indicating vulnerable customers

- Potential mis-selling or unsuitable advice

- Non-compliant financial promotions

The software sends instant alerts to designated teams. You can act before issues escalate.

2. Conversation intelligence

Specialized conversation intelligence platforms analyze calls for compliance patterns.

They capture sentiment, detect friction points, and identify where customers don’t understand key information.

This data feeds directly into your Consumer duty outcomes monitoring.

3. Automated reporting

Good compliance monitoring software automatically produces audit-ready reports. These show regulators every breach identified and the actions you took.

This evidence significantly reduces financial and reputational risk.

H. Tips to build a compliance culture that lasts

Technology provides the tools, but people make compliance real every day. Here are the cultural foundations you need:

1. Leadership sets the tone

Senior managers must visibly prioritize compliance. When leadership treats monitoring as strategic rather than administrative, the organization follows.

2. Training must be practical

Move beyond generic training modules. Use real examples from your monitoring data. Show staff what good and poor outcomes look like in practice.

The FCA shares examples of good and poor practice through multi-firm reviews. Use these as teaching tools.

3. Empower frontline staff

Your contact center agents and advisers interact with customers daily. They spot vulnerability indicators and hear customer frustrations first.

Give them clear escalation paths. Recognize when they flag potential issues.

4. Celebrate compliance wins

When monitoring identifies a problem early, preventing customer harm, celebrate that. Show teams that compliance monitoring protects customers and the firm.

Conclusion

FCA compliance monitoring has fundamentally changed. The regulator expects you to prevent harm, not just detect it.

You must continuously monitor outcomes and prove that your customers receive fair value, clear communication, and appropriate support.

The firms that thrive treat compliance monitoring as a strategic advantage. They use data to understand customer needs better. They identify and fix issues before regulators intervene.

Looking for an advanced tool for FCA compliance monitoring?

Enthu.AI’s Agentic AI platform transforms FCA compliance monitoring by analyzing 100% of customer calls in real time.

Our automated quality assurance flags missing disclosures, vulnerable customer indicators, and non-compliant language instantly, producing audit-ready evidence that regulators demand.

Don’t wait for the next enforcement action.

Schedule a demo today to discover how AI-powered monitoring protects your customers, reduces regulatory risk, and builds competitive advantage.

FAQs

1. What is FCA in compliance?

The FCA (Financial Conduct Authority) is the UK’s primary conduct regulator for financial services. It oversees firms to ensure they meet regulatory standards, protect consumers, and maintain market integrity.

2. What is compliance monitoring?

Compliance monitoring is the continuous, systematic assessment of business activities to ensure adherence to regulatory requirements and internal policies. Unlike one-time audits, it provides ongoing oversight through real-time surveillance, regular reviews, and data analysis to detect risks early and prevent violations.

3. How often should FCA compliance monitoring be conducted?

Monitoring frequency depends on risk levels. High-risk activities require continuous, real-time monitoring, while medium-risk areas need monthly reviews and lower-risk activities use quarterly assessments. Board reporting should occur at least quarterly to maintain oversight.

4. How does technology improve FCA compliance monitoring?

AI-powered monitoring software reviews 100% of customer interactions versus just 2-5% with manual methods. It identifies compliance breaches in real time, sends instant alerts, and automatically produces audit-ready evidence for regulators.

5. What data should firms collect for Consumer Duty outcomes monitoring?

Essential data includes complaints segmented by product, customer satisfaction scores, call quality metrics, claims ratios, persistency rates, pricing benchmarks, and cancellation patterns.

On this page

On this page