Every dollar in finance depends on trust, and trust is built (or broken) during a sales call.

Manual review of sales calls in financial services is slow, inconsistent, and often misses key details.

Most contact centers can only manually evaluate 1-2% of interactions, leaving a significant blind spot.

Important cues or compliance slip-ups may go unnoticed, undermining customer trust and potentially leading to lost business.

In an industry where one bad experience can drive 80% of customers away, traditional call monitoring is simply not enough.

This article explains how AI transforms sales call analysis for banks, lenders, insurers, and fintechs.

You’ll learn why analyzing sales conversations is critical, how AI simplifies the process, the benefits for financial call centers, and a practical roadmap to get started.

Upload Call & Get Insights

DOWNLOAD DUMMY FILE

DOWNLOAD DUMMY FILE 1. Why sales call analysis matters in finance

Sales calls are the lifeblood of the financial services industry.

Whether it’s approving a loan, selling an insurance policy, or guiding a wealth management client, critical decisions happen over the phone.

When you analyze those conversations, you protect trust and unlock growth.

- 66% of banking customers and 57% of investment clients prefer calling a live agent when making a purchase.

- Phone callers are high intent, often driving 10-15× more revenue than web leads.

- Missed insights lead to lost deals and churn; a single bad call can often deter most customers.

- Compliance stakes are real: TCPA, PCI DSS, and FDCPA govern every conversation.

- Penalties bite hard – Dish Network faced a $280M fine for telemarketing breaches.

- Nearly 96% of contact centers report that compliance is challenging to enforce at scale.

- Structured analysis helps: monitor 100% of calls, surface risks instantly, and coach with data.

Use AI to systematize this. Every reviewed call becomes a coaching moment.

You lift conversion, reduce compliance exposure, and grow lifetime value without adding headcount.

B. Challenges with manual call analysis

QA teams sample a small number of calls, hoping to catch the significant issues.

Most of the story goes unseen, so coaching and compliance stay reactive.

Here are some significant challenges with manual call analysis:

- Tiny coverage: Humans review <5% of calls. Over 95% go unchecked.

- Lost context: Sampling is like watching random movie scenes. You miss the plot.

- Subjective scoring: One analyst gives 85%, another 65% – the same call, viewed through different lenses.

- Time sink: Listening, note-taking, and logging eat hours every week.

- Compliance gaps: Missed disclosures or risky promises slip through rare audits.

- Slow feedback: Agents wait days for notes; momentum fades.

- Hidden patterns: You can’t spot fee confusion or policy misunderstandings at scale.

- Spreadsheet sprawl: Scores live in silos, making it hard to connect trends.

- Volume shocks: Spikes in calls break already thin QA coverage.

- Morale hit: Inconsistent reviews frustrate agents and erode trust in the QA process.

Bottom line: manual QA can’t keep pace. You need systematic, scalable analysis to see every call, surface risks instantly, and coach with data.

C. How to choose the right call QA platform

If you’re considering AI for call monitoring and quality assurance in finance, it’s crucial to pick the right platform.

Look for these key capabilities:

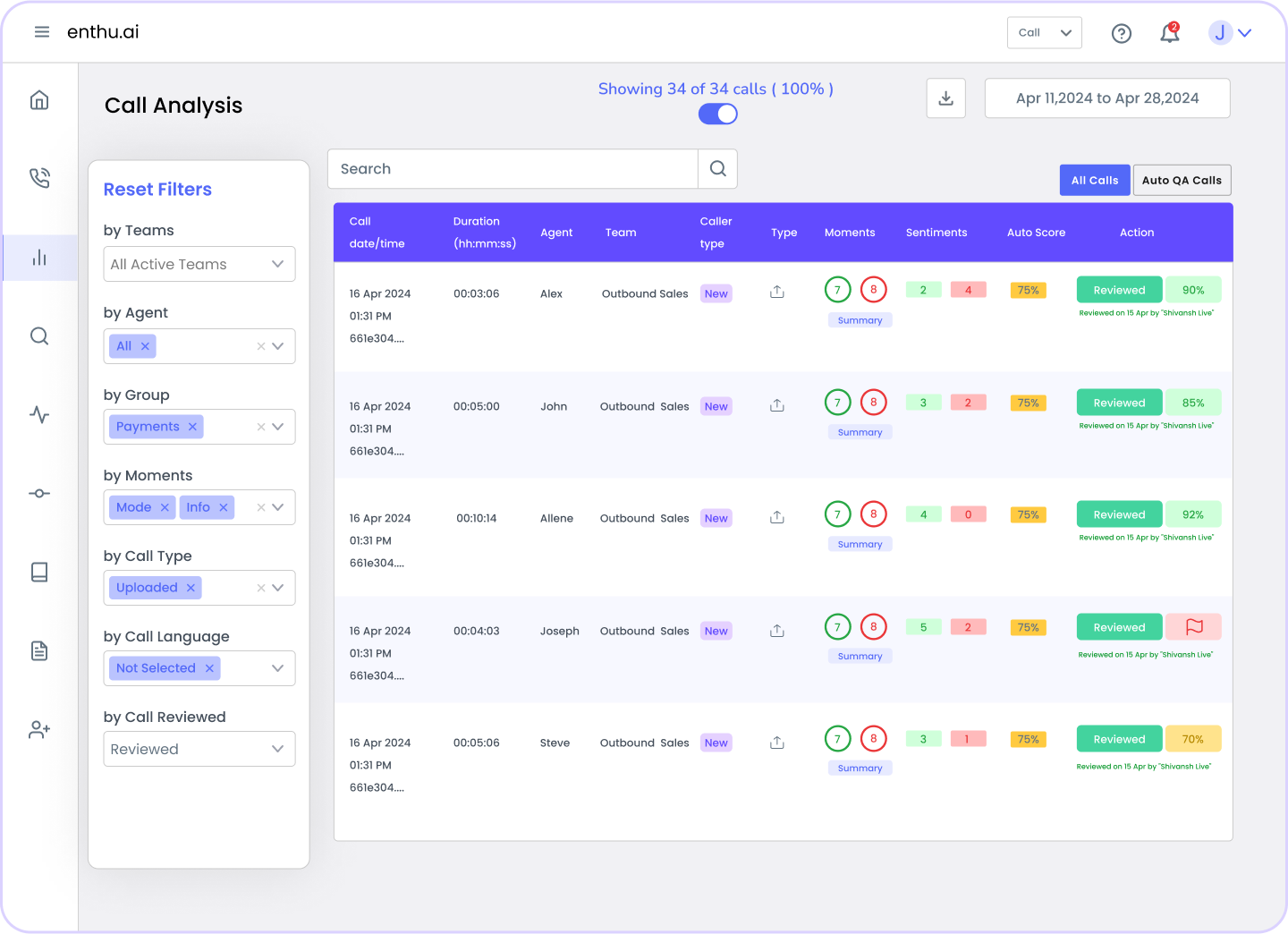

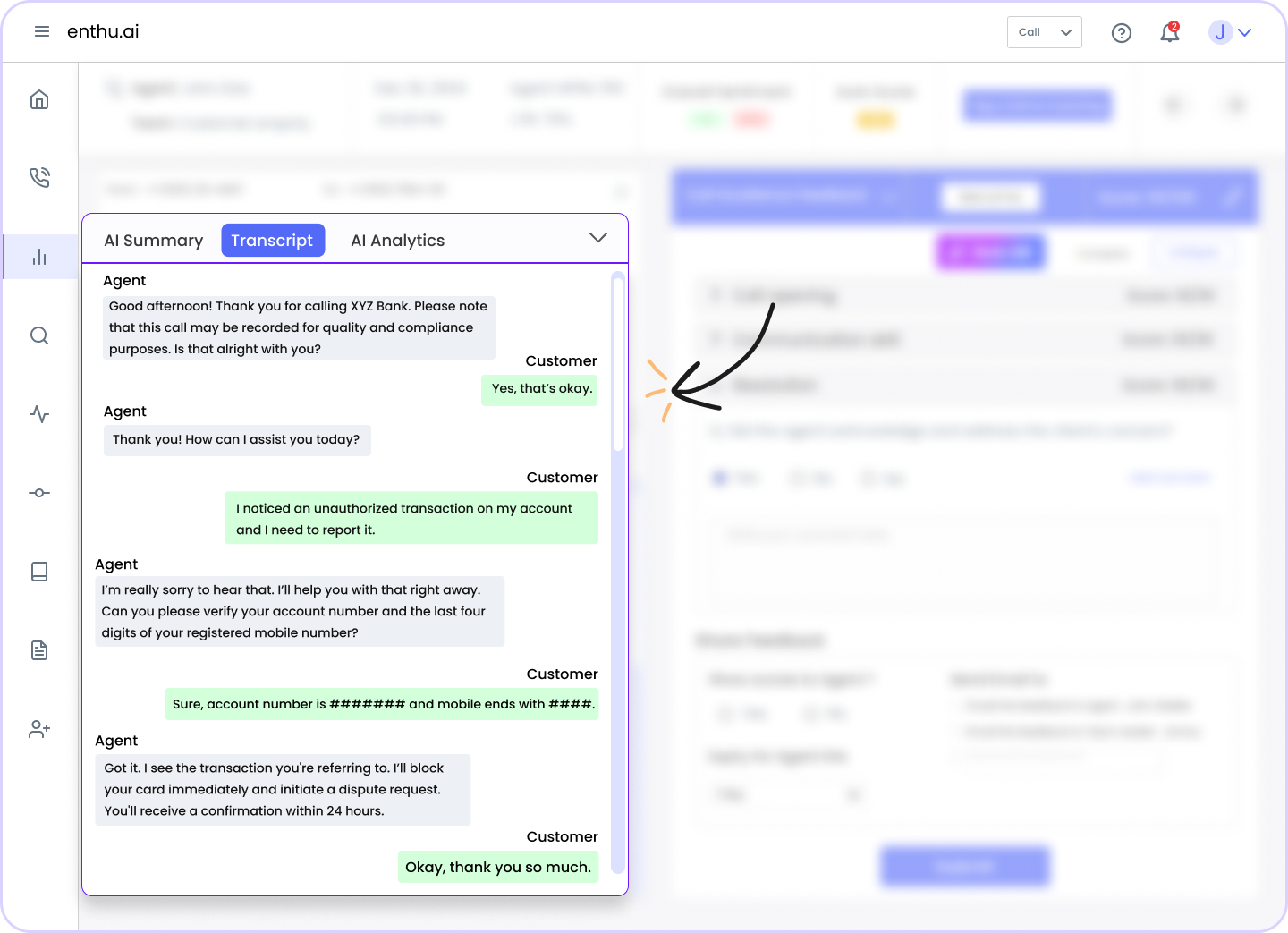

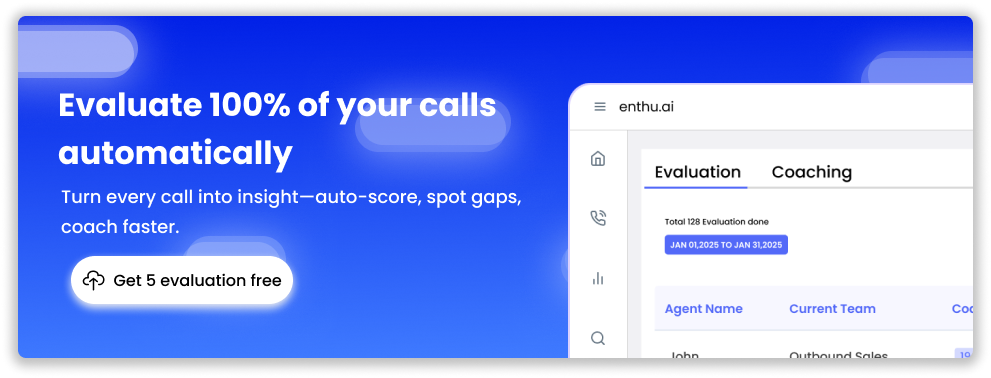

1. Transcribes and analyzes 100% of calls

The platform should capture every conversation, not just a sample of it.

AI speech recognition creates searchable transcripts of every call, so nothing is missed.

By scoring 100% of calls, you ensure complete coverage, rather than manually sampling 1-2%.

This is especially vital in finance, where even one unreviewed call could contain a compliance landmine.

Make sure the AI can handle financial terminology and accents common in your customer base.

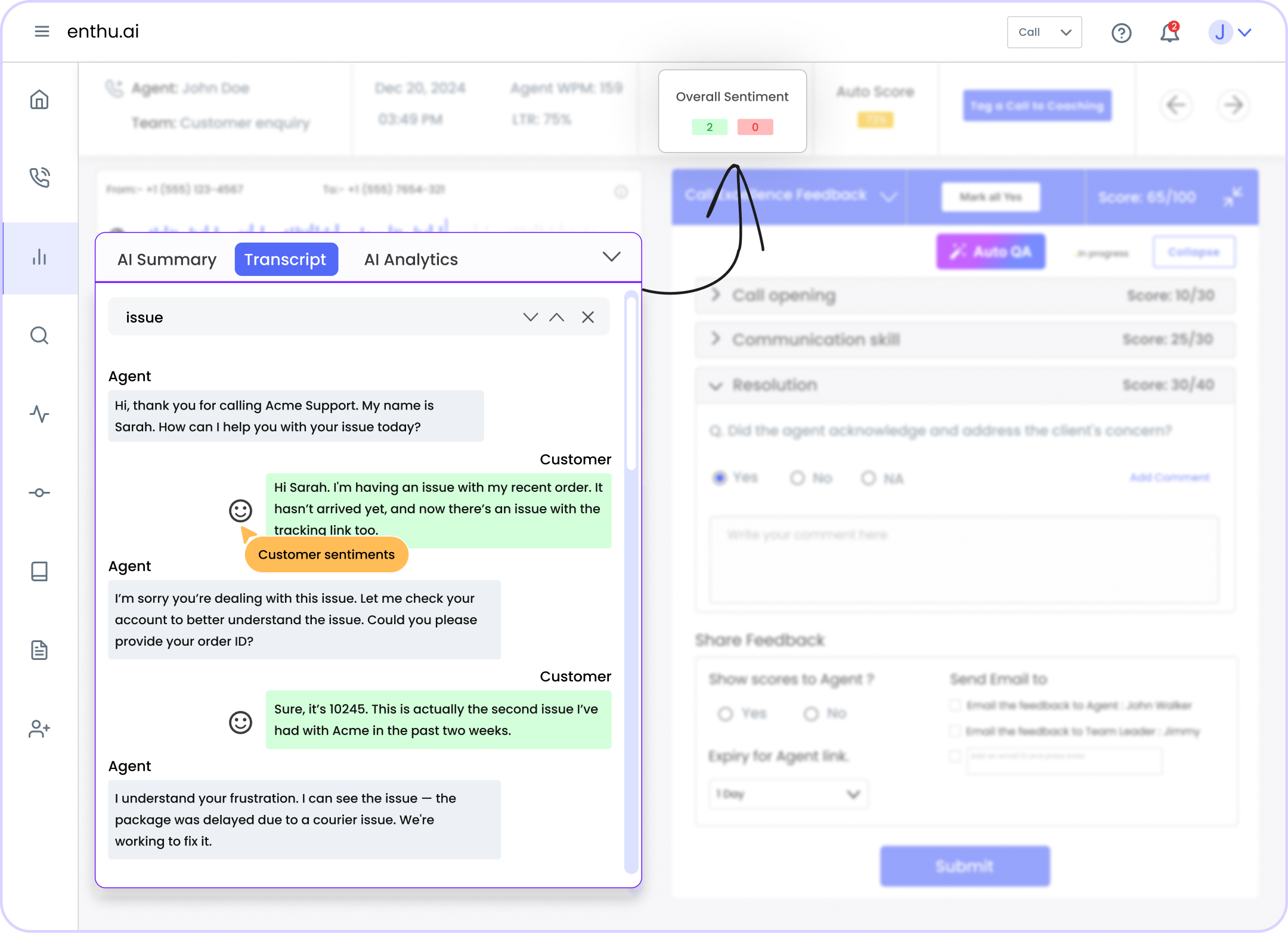

2. Detects keywords, intent, and sentiment

An intelligent AI platform goes beyond transcription.

It should understand what’s being said and how it’s being said.

Keyword spotting lets you track essential terms (product names, competitor mentions, “cancel my account,” etc.) to gauge customer intent and interest.

Sentiment analysis evaluates tone and emotion, flagging when a customer sounds frustrated or an agent sounds unempathetic.

This helps you pinpoint moments where trust falters.

3. Flags compliance risks instantly

In finance, compliance is non-negotiable.

Your AI QA platform must automatically identify and correct any compliance lapses during calls.

This involves checking each call for required disclosures, prohibited phrases, and the handling of sensitive data.

The AI should immediately flag if:

- An agent forgot a mandatory disclaimer,

- Made a risky promise about rates/returns,

- Or strayed off the approved script.

Real-time or fast alerts let you correct issues before they escalate.

Look for features like PCI DSS redaction and customizable lists of terms to monitor.

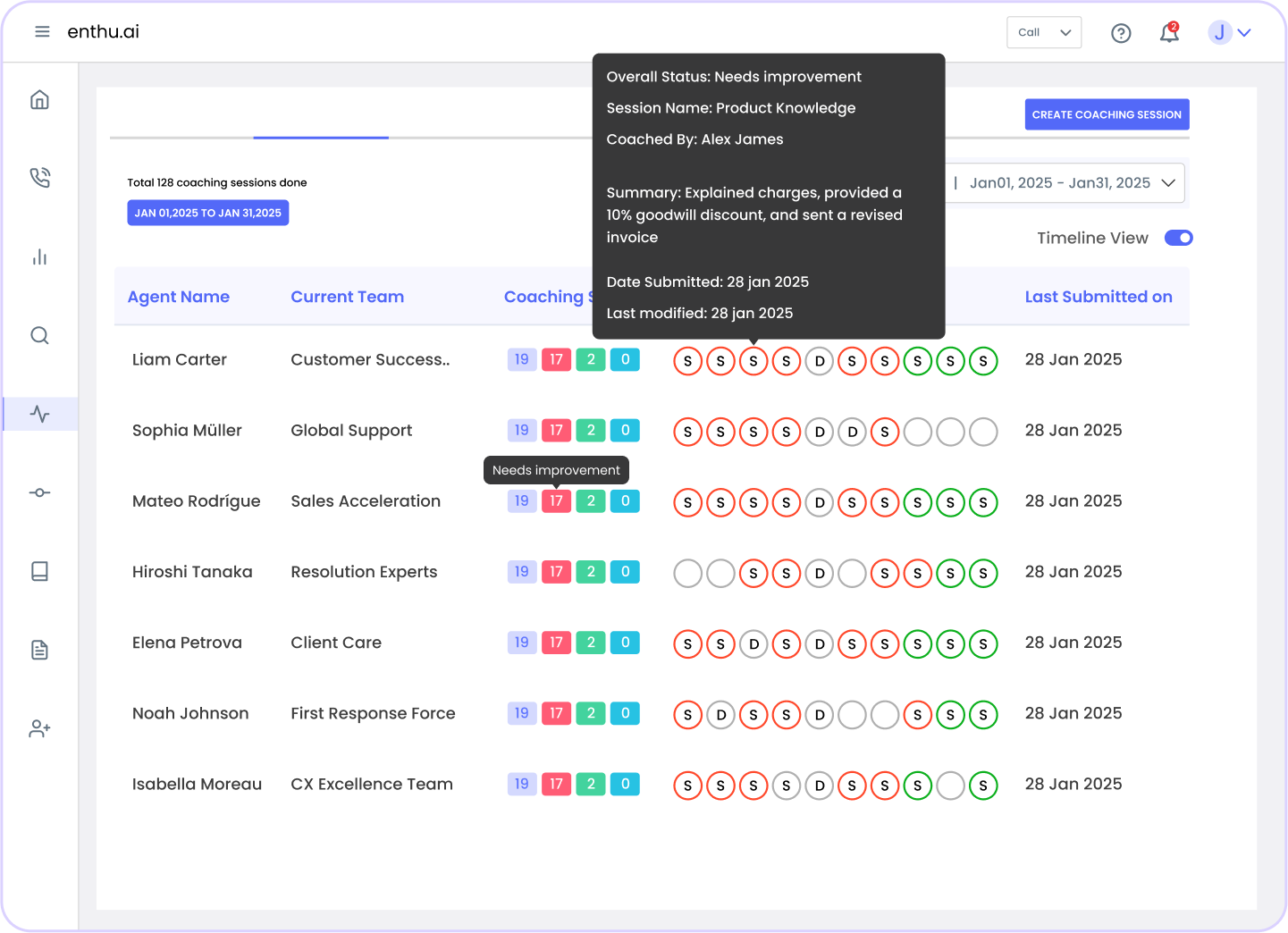

4. Generates coaching insights

A quality AI platform will provide actionable feedback for each rep and call.

This includes metrics such as the talk-to-listen ratio, patience, and empathy cues.

It can highlight objection-handling moments.

For example, how did the representative respond when the customer said, “I need to think about it” or raised a pricing concern?

By analyzing behavior at scale, AI finds coachable moments that improve conversion.

It might reveal that top performers pause after asking a question, or that struggling agents often miss upsell cues.

The platform should turn these patterns into simple dashboards or scorecards.

Managers can then give targeted feedback.

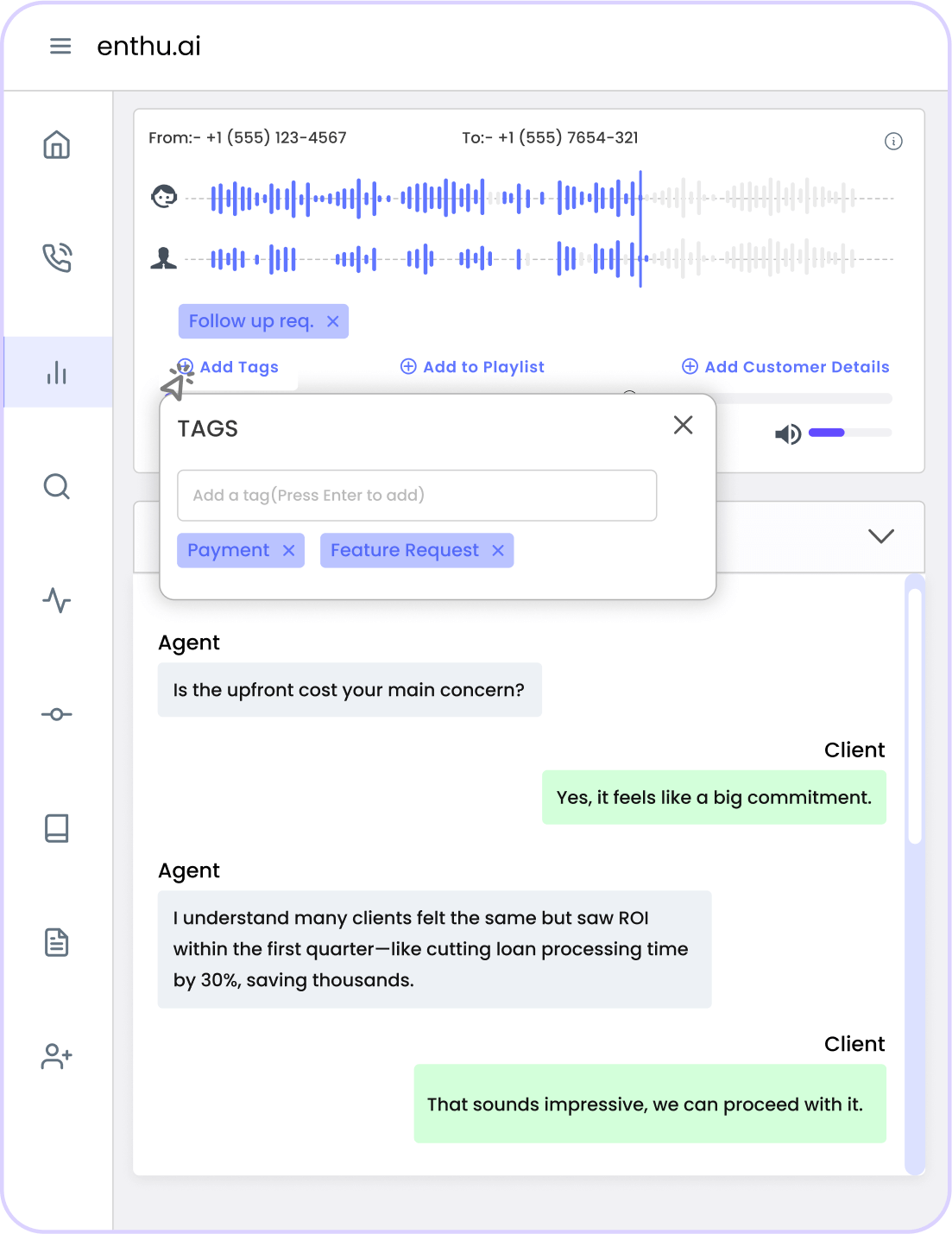

5. Spot sales opportunities

Beyond QA and compliance, the right AI tool will help you grow sales by mining calls for opportunities.

It picks up on cues like:

- A customer mentioning a competitor’s product,

- Hinting interest in another service,

- Or life events that signal a new need

By auto-tagging these moments, the platform enables you to follow up on leads and capitalize on upsell opportunities that would otherwise be lost.

Over time, you can even analyze which phrases or offers lead to successful upsells.

For financial institutions, it means every call can reveal a future revenue opportunity.

Ensure the AI has flexible call tagging and topic analysis capabilities, allowing you to customize it to your specific products and campaigns.

6. Automates call tagging & workflow

Finally, a great call analysis solution should save your team time on busywork.

Look for automation features that categorize and route calls automatically.

For example, it should auto-tag calls by outcome or topic, based on the conversation content.

An AI could:

- Update your CRM with call notes,

- Create a follow-up task for an agent,

- Or send an alert if a high-value client had a poor experience.

The platform must integrate seamlessly with your existing CRM, dialer, or contact center software to push these insights effectively.

When done correctly, managers no longer have to log call outcomes or review recordings manually.

Hours of manual logging and QA work are eliminated, freeing leaders to focus on coaching and strategy.

D. Step-by-step roadmap to get started

Implementing AI for sales call analysis in a financial organization might seem daunting, but it’s pretty straightforward if you take it step by step:

1. Define clear goals

Decide what success looks like.

Is your priority compliance, conversion lift, QA efficiency, or all three?

List pain points and map target metrics – adherence rate, conversion, average QA score, CSAT, and handle time.

Prioritize features accordingly: disclosure checks for compliance, coaching analytics for sales, workflow automation for QA.

2. Run a focused pilot

Start small and controlled.

- Pick one team or product line, such as mortgages, and run a four-week pilot.

- Compare AI findings to your current process.

- Validate transcription accuracy and the relevance of flags.

- Capture manager and agent feedback.

Use Enthu.AI’s five free evaluations to test workflows, fine-tune keywords, and secure buy-in before scaling.

3. Track KPIs and ROI

Measure impact from day one.

Establish baselines for conversion, compliance adherence, QA hours, CSAT, and rework.

After rollout, track deltas: violations flagged and resolved, time saved per scorecard, revenue lift from coached calls.

Pair quantitative results with qualitative insights – objection themes, friction points to build a clear ROI story and justify expansion.

4. Train and iterate

Enable adoption with training.

Show QA leads and supervisors how to filter by sentiment, intent, and talk ratio, and how to drill into transcripts.

Run short agent workshops that frame AI as a coach, not a cop.

Collect feedback on false positives and missing phrases, and then continuously adjust AI models and keyword packs accordingly.

5. Scale and deepen integrations

Expand to adjacent teams and call types in phases, and deepen integrations with your CRM and dialer.

Enable advanced capabilities, including auto-tagging, script adherence, and real-time assistance after foundation metrics stabilize.

Keep a live KPI dashboard. Celebrate wins widely.

E. The future of AI in financial call analysis

The future is bright and fast-evolving for AI in financial services call centers.

Here’s a glimpse of what’s on the horizon:

1. AI as a compliance guardian

AI becomes your real-time compliance guardian.

It monitors every conversation, checks evolving TCPA/PCI/FDCPA rules, and nudges agents to deliver required disclosures at the right moment.

If risk appears, stating that card data is spoken can automatically mask or pause payment flows.

Always-on oversight reduces violations, speeds remediation, and shifts you from after-the-fact audits to proactive protection.

2. Predictive insights and personalization

Predictive analytics turns voice data into foresight.

By identifying patterns across millions of calls, AI forecasts customer needs, churn risk, and recommends next-best offers.

You receive alerts such as “high likelihood to refinance” or “concerned about premiums,” and route callers to the right specialist.

Personalized timing and messaging increase conversion rates, reduce attrition, and inform more effective campaigns and staffing decisions.

3. AI-driven coaching and agent assistance

AI compares behaviors to those of top performers, then guides reps with live tips – slow down, ask a clarifying question, or offer option B.

Simulated role-plays accelerate ramp time, while post-call scorecards highlight talk ratio, empathy, and objection handling.

Routine analysis is automated, allowing managers to focus on strategy, while humans deliver empathy.

Conclusion

AI-powered call analysis gives finance teams trust and efficiency. With 100% call coverage, you can spot risks, surface intent, and coach more effectively.

No more random samples or missed disclosures. Leaders get clear insights on objections, opportunities, and compliance, all in one place.

Moving from manual QA to automated scoring is a leap forward.

Agents receive timely, objective feedback.

Managers save hours every week. Customers get consistent, confident guidance.

Firms using Enthu.AI report higher conversions and near-zero violations, without adding headcount.

FAQs

1. How does AI help ensure compliance on sales calls?

AI monitors 100% of calls and flags risks in seconds. It checks required disclosures, identity verification, and banned phrases. PCI data is redacted automatically, helping you avoid fines.

2. Will AI replace human QA analysts or sales coaches?

No. AI augments your team. It transcribes, scores, and surfaces issues at scale. Humans coach nuance and empathy; QA time shifts to training.

3. How quickly can we deploy an AI call analysis solution?

Cloud setups launch in days, not months. Connect recordings or VoIP, start a small pilot, then scale. Enthu.AI onboarding is lightweight; insights begin immediately.

4. how to use ai to measure talk-to-listen ratio on sales calls?

AI like Gong or Fireflies to automate speaker tracking. Use their data to master “Golden Silence” a two-second pause after prospects speak to ensure your ratio reflects genuine human connection, not just data.

On this page

On this page