INSURANCE BROKING

Build Trust, One Conversation at a Time

Insurance business is built on trust, empathy, and clarity. Whether it’s guiding customers through policy options, handling claims, or retaining loyal clients, every conversation matters. With Enthu.AI, you can ensure your conversations are effective, compliant, and customer-focused.

30-day PoC available

Quick setup

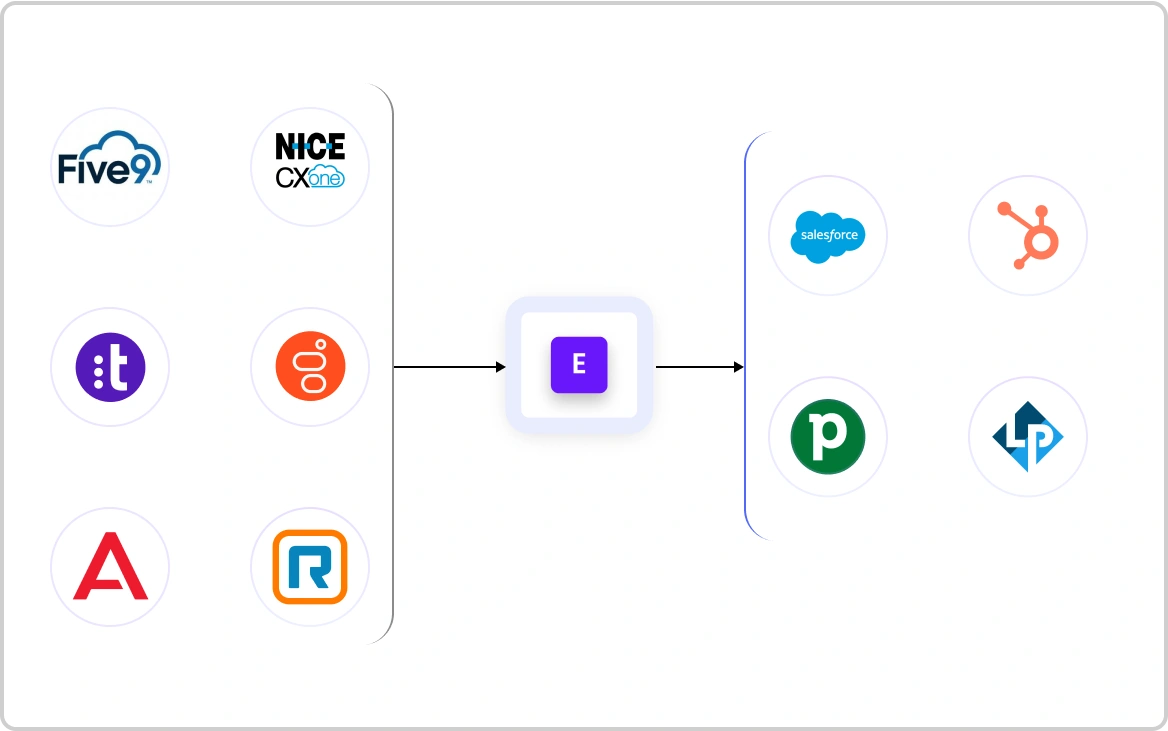

30+ integrations supported

Who's growing with Enthu.AI?

Use cases tailored for Insurance Companies

Increase policy conversions

Analyze sales calls to understand the techniques that resonate with customers and coach agents to replicate those successes.

Ensure compliance, always

Monitor 100% of calls for adherence to industry regulations, script guidelines, and disclosure standards, protecting your brand and your customers.

Enhance claims handling

Gain insights into claims-related conversations to identify pain points, improve clarity, and streamline resolution processes.

Retain loyal policyholders

Analyze renewal conversations to understand customer concerns and increase retention rates through proactive solutions.

How success looks like in numbers

With Enthu.AI, Insurance companies have achieved.

28%

Increase in policy conversion rates

95%

Reduction in compliance violations

80%

Improvement in agent score

65%

Improvement in CSAT

Top features designed for growing contact centers

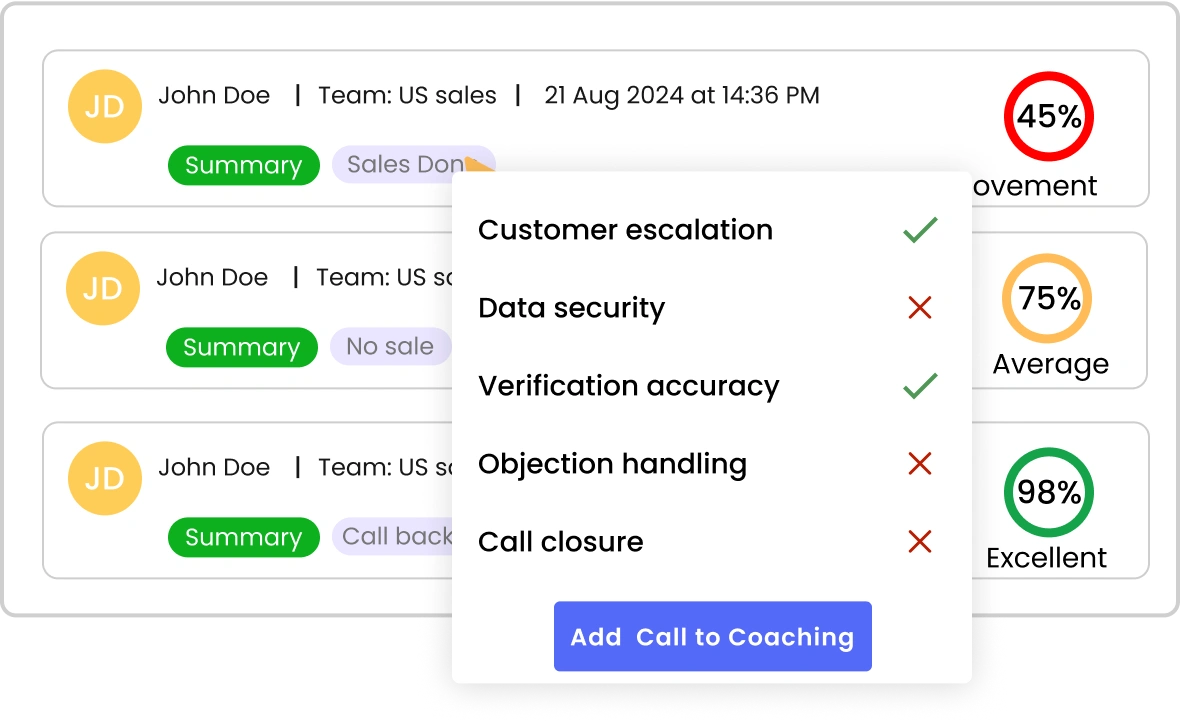

Automated quality monitoring

Evaluate 100% of customer calls with AI-driven quality analysis to ensure compliance and performance at scale. No more random sampling—monitor interactions at scale.

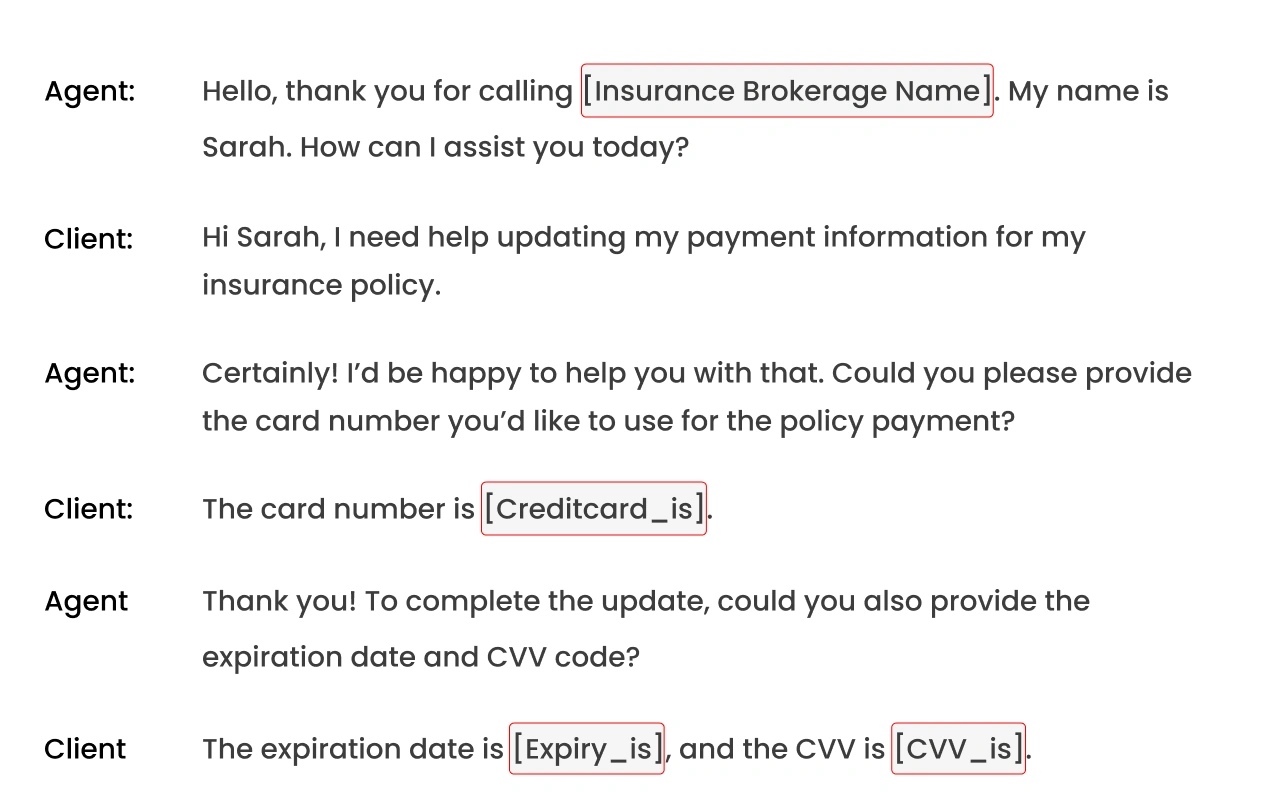

PHI/PII redaction

Safeguard sensitive customer data with automatic redaction of payment card information, social security numbers, and other personally identifiable details.

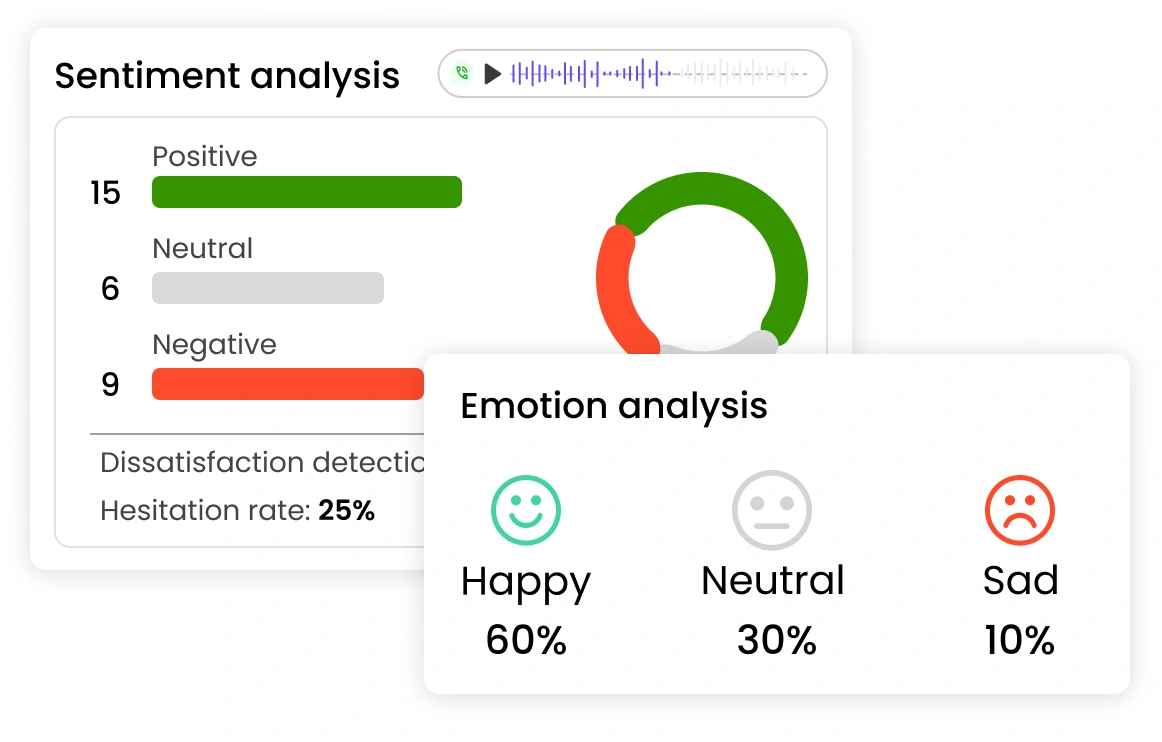

Sentiment and emotion analysis

Capture and analyze customer sentiment to identify dissatisfaction, hesitation, or delight. Use these insights to train agents and improve call outcomes.

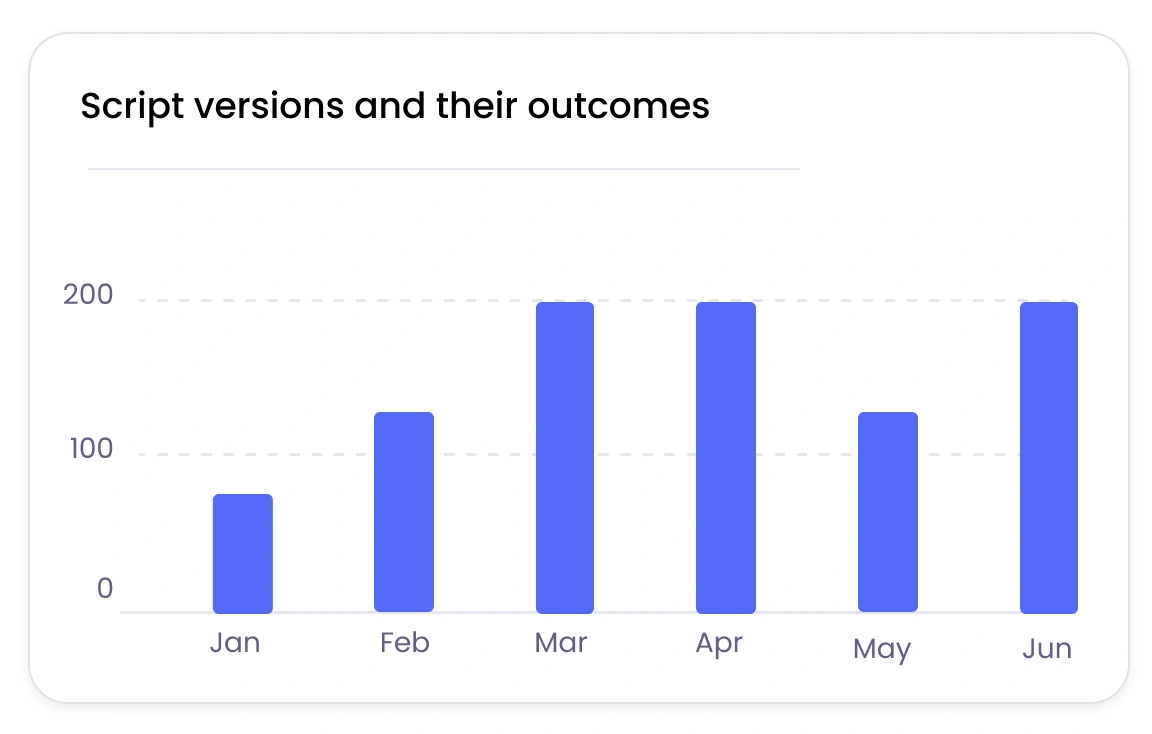

Script adherence tracking

Ensure agents are sticking to approved scripts for compliance and regulatory needs. Get instant alerts for deviations that could lead to risk.

Seamless CRM integration

Sync call insights directly with tools like Salesforce, HubSpot or customer CRMs to create a unified view of customer interactions, improving follow-ups and sales processes.

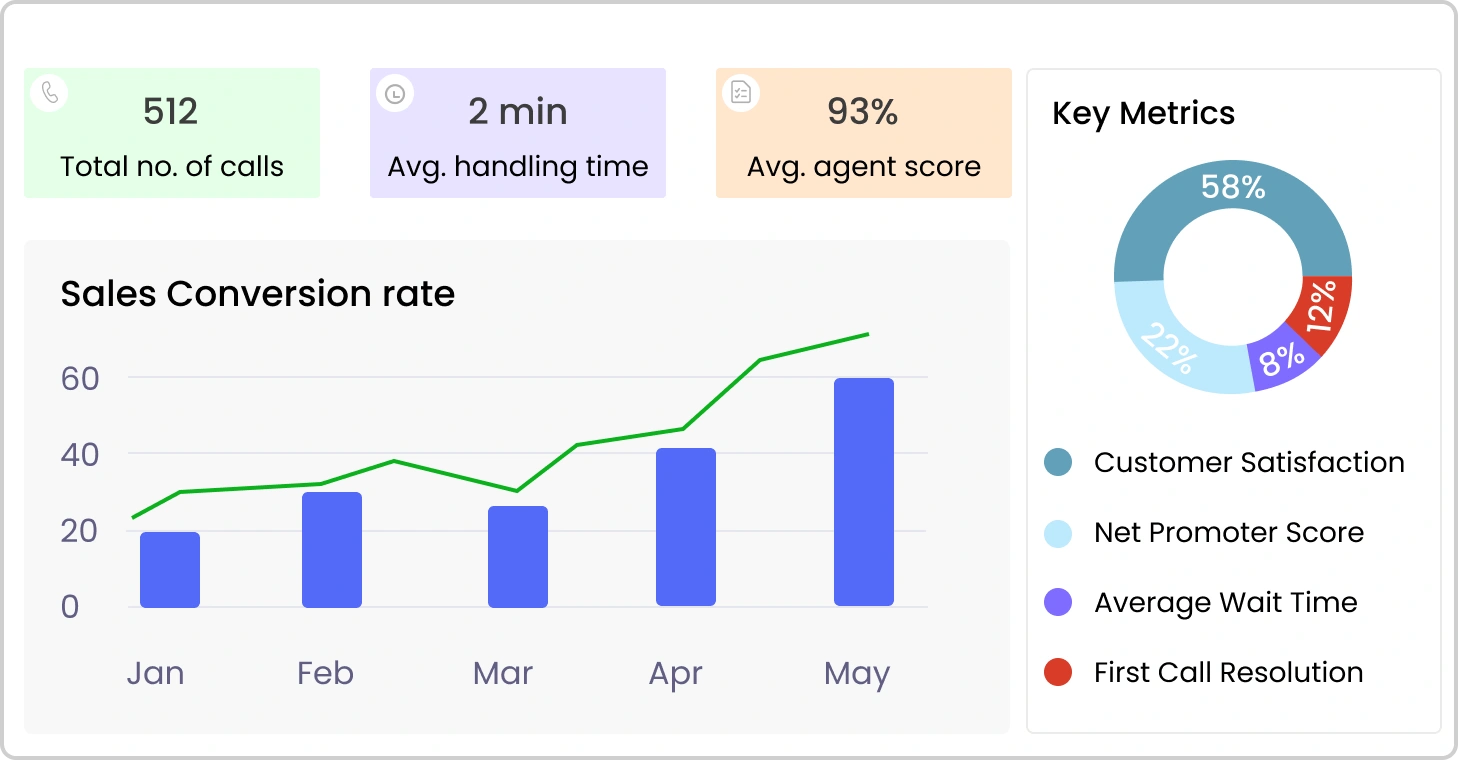

Advanced reporting and dashboards

Visualize metrics like average handling time, conversion rates, compliance adherence and much more, in customizable reports and dashboards.

Fastest implementation, best support & quickest RoI across all

quality management software

Stop letting missed insights holding you back!

30-day PoC available

Quick setup

30+ integrations supported